Kira try a writer and you may illustrator specializing in personal money. She retains a diploma for the business artwork from Indiana College or university and you may was completing their own MBA regarding Nova Southeastern College or university.

Federal student loan individuals have seen a pleasant reprieve out-of repayments the past long-time. Individuals with figuratively speaking during the default, not, was required to live with the newest looming risk of default status becoming applied whenever the commission stop was more than.

To help with these types of consumers, brand new U.S. Service of Degree developed the New Start program. The application enables individuals with standard figuratively speaking so you’re able to win back current status and you can lso are-schools their qualification to possess money-motivated payment preparations, other kinds of authorities-recognized financing, and much more.

Individuals should act prompt for taking advantageous asset of it government program. New automatic masters simply past 12 months adopting the commission stop ends up therefore individuals have up until , to enroll and just have off default.

To help you qualify for the newest Initiate program having student loans, you’ll want had government figuratively speaking within the default out-of prior to this new COVID-19 payment freeze become towards the . Private money of any sort aren’t qualified. But not, only a few government loan types are automatically eligible both.

- Defaulted William D. Ford Government Head Mortgage (Head Mortgage) System money

- Defaulted Government Loved ones Student loan (FFEL) System financing

- Defaulted Perkins Money stored by ED

- Defaulted Perkins Loans kept because of the schools

- Defaulted Fitness Knowledge Guidance Mortgage Program funds

- Figuratively speaking remaining with the U.S. Agencies out-of Fairness having constant lawsuits

- Head Fund you to definitely default following end of your COVID-19 student loan fee stop

- FFEL System financing that standard after the http://clickcashadvance.com/personal-loans-sc/central stop of one’s COVID-19 education loan percentage pause

Getting started off with New Start

New subscription techniques should be quick. Get it done whenever you normally to begin with a repayment package and also have off obligations fundamentally.

1: Ensure whom keeps your loans

See whom the loan holder is when that you don’t learn currently. If your defaulted money range from the above being qualified designs, it is more than likely the latest U.S. Institution from Education.

You can name step one-800-621-3115 if you’re not sure who retains their financing. Folks who are deaf otherwise hard-of-hearing should telephone call step one-877-825-9923.

2: Gather pointers

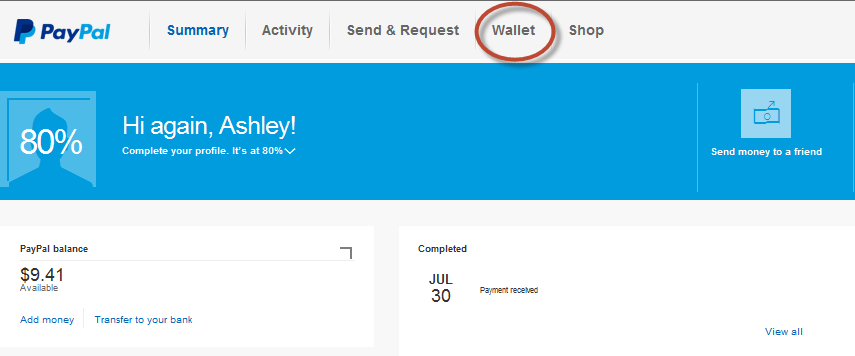

![]()

Enjoys personal data like your public shelter amount helpful. Also, attempt to gather your newest government tax get back, in the event lacking that should not prevent you from contacting.

3: Contact your financing holder

Get hold of your mortgage servicer otherwise contact this new Agencies out-of Training actually for federally-stored loans. This can be done online through myeddebt.ed.gov or label 1-800-621-3115. People who are deaf otherwise hard-of-hearing normally label this number: 1-877-825-9923.

To start the procedure by send instead, write a page with your term, social safety number, and you may date off beginning. Be sure to range from the after the terminology: I wish to use New Beginning to provide my personal financing back again to a great status.

What takes place next?

- This new Agency out-of Education tend to import your funds to help you financing servicer and you may from the Standard Resolution Classification otherwise warranty institution. This may capture 4 to 6 days.

New Start’s automatic positives

People who join Fresh Start will get such benefits from the newest Department regarding Degree automatically. You can preserve them by using the application to obtain away from standard and you will pay back the debt.

Work for #1: Use of government college student help

Consumers which have defaulted financing are unable to sign up for any further money due to government college student aid. Which have Fresh Start, that is no further possible. That you don’t have even to go to into the money so you can commercially transfer out of the Standard Resolution Group you might apply for support playing with FAFSA once you happen to be enrolled in Fresh Initiate.