Downsides regarding assumable mortgage loans:

- To own Consumers: You need to nevertheless get the mortgage and you can meet their requirements, restricting the selection of loan providers. You don’t need to the luxurious of shopping around to possess a loan provider as you will need to be accepted getting, or take on regards to current home loan.

- Getting People: As previously mentioned earlier, should your vendor enjoys good-sized family collateral, you’ll likely must developed the cash to possess a life threatening downpayment, which instant same day payday loans online Tennessee is an economic challenge.

- For Consumers: If a supplier understands the new desirability of the home by assumable financial, this may raise demand for the house and allow these to improve the purchase price, making the provide process way more competitive. Because the a buyer, we want to be cautious not to ever overpay into household into sole reason for inheriting the loan. Its a smart idea to assess the newest monthly payments for all of the residential property it comes to observe how they examine.

Variety of Assumable Mortgage loans

To imagine an FHA financing, you need to meet up with the basic FHA mortgage standards, that can were and make the absolute minimum advance payment out-of 3.5 percent and having a credit score with a minimum of 580.

It is vital to keep in mind that antique money usually are not assumable, except within the specific facts, particularly shortly after passing otherwise divorce.

How exactly to Imagine a mortgage

Prior to whenever a mortgage, you must see recognition regarding brand-new lender. Which usually comes to appointment the same requirements while the acquiring a typical home loan, such a qualifying credit history and a reduced personal debt-to-income ratio. Here you will find the general methods to follow along with:

- Establish Assumability: Make sure if the financing try assumable and you will speak with the modern financial holder’s bank to make certain they allow expectation. You can also first want to get touching owner in order to have the contact information toward brand-new financial.

- Get ready for Can cost you: Learn the remaining harmony toward mortgage and that means you does the new math on the dollars you will need to give closure. If you feel the rest harmony will need even more capital, initiate shopping around to have lenders that may offer can see the newest words (note that this will are different to the current rates of interest, and so they may be reduced beneficial terms as compared to financial your try assuming)

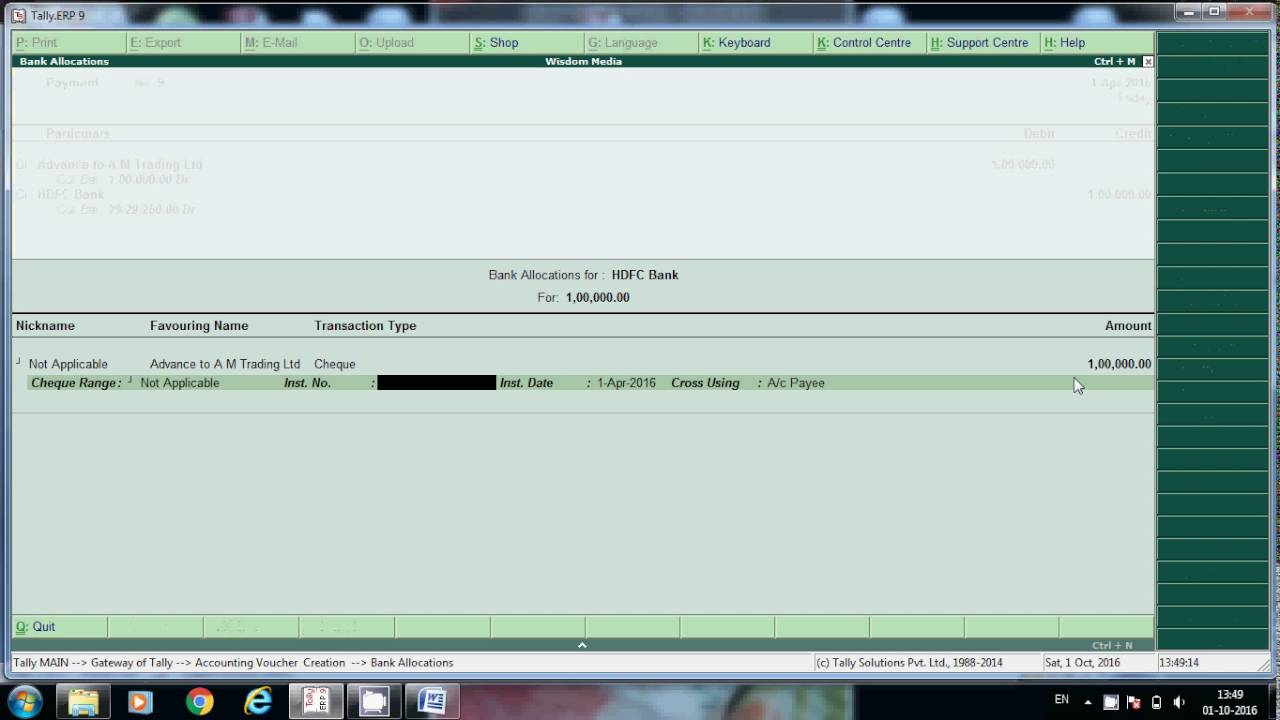

- Fill out an application: Fill out an application, give required forms, and fill out character. The process may differ according to lender.

- Romantic and you can Signal Launch of Liability: As the presumption of your own financial might have been acknowledged, you happen to be handling the very last stage of the process. Like closure various other home loan, you will need to finish the called for paperwork to be sure a smooth changeover. You to important document that frequently comes into play is the launch off liability, and that caters to to ensure that the vendor is no longer in control to your home loan.

With this stage, its important to pay close attention to the main points of the release of liability. Make sure that all the necessary data are accurately noted, including the brands and make contact with specifics of both parties, the property target, the loan information, and just about every other relevant advice. Evaluating new document with care can help prevent people distress or judge difficulties afterwards.

Contemplate, the fresh finalizing of your discharge of responsibility stands for a significant changeover for the consumer and seller. It scratches once in the event the burn was introduced, together with buyer assumes on full responsibility for the mortgage. By the doing this faithfully and you can carefully, you may make a strong base to own a successful and legitimately joining assumable financial agreement.