Refinancing shortly after forbearance

Just how long you will be expected to wait is determined by the fresh new things of one’s monetaray hardship and you will if your leftover up with people planned repayments found in the forbearance package.

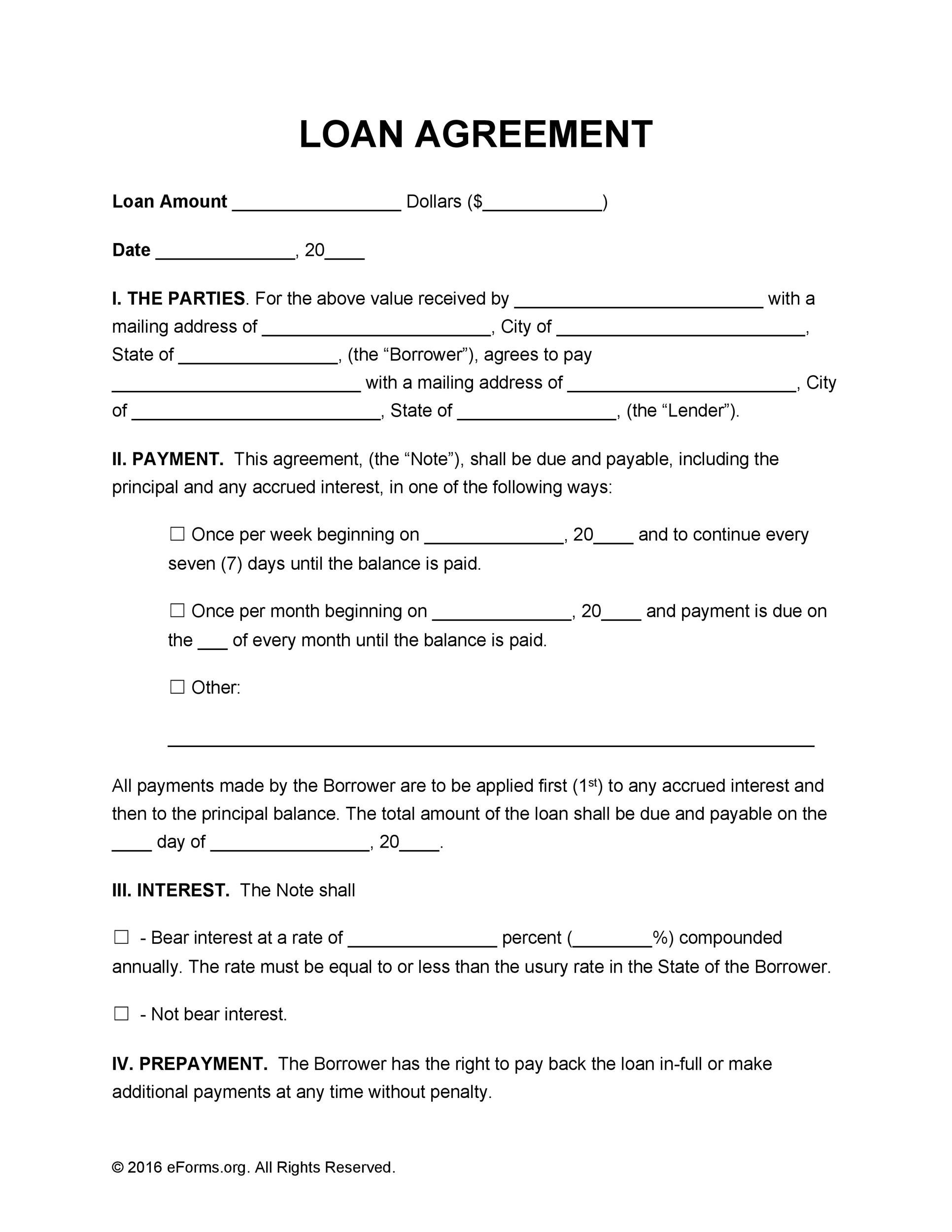

For those who inserted forbearance on account of COVID-19, you usually need not waiting whatsoever, as long as you’ve made your most recent three to six payments punctually. The brand new table lower than shows the important points:

Although not, when your issues had been unrelated so you can Portland installment loan no credi checks no bank account COVID, you could be caught waiting for as much as one year just before you might refinance.

Refinancing immediately following mortgage loan modification

If you’ve become through the mortgage loan modification processes with your bank, you can routinely have to attend twelve in order to 24 months adopting the loan mod to qualify for a great refinance. However, whether your mortgage loan modification is actually when you exited a beneficial COVID-19 forbearance system, you don’t need to waiting, if you generated the past six so you can several payments of your own loan mod on time.

Alternatives to refinancing which have late repayments

If you’re unable to refinance their financial, you’ve got a number of solutions to fall right back towards the. Your own real action to take will depend on their home loan particular, exactly how prior-due you are along with your lender’s options. While some of those choice will let you remain in their domestic, anyone else dont.

Consult with your financial immediately to discuss your options and next steps. A great HUD-approved homes counselor also can bring subsequent suggestions.

Installment plan

With an installment bundle, their bank will give you a structured agreement in order to meet their late or unpaid mortgage repayments. This may involve purchasing part of the early in the day-owed matter along with your monthly installments before mortgage is actually latest. Your own financial ount through to the prevent of the loan identity.

Entering an installment package enables you to remain in your house and you may give the mortgage newest if you fail to re-finance the delinquent mortgage.

Financial forbearance

Whenever you are sense monetaray hardship – death of a position, problems, absolute emergency or other situations – you can also be eligible for home loan forbearance. That have a home loan forbearance, your own bank have a tendency to

Keep in mind that forbearance cannot get rid of the paused or faster payments. Desire with the loan will continue to accrue, plus financial gives alternatives for recovering the reduced or paused number.

Mortgage modification

Home financing modification cuts back your monthly payment from the switching the latest terms and conditions of your own financing. Eg, your lender will get modify your home loan from the extending the loan name, reducing the interest or reducing the dominant harmony.

It’s easy to confuse mortgage loan modification with refinancing, nevertheless the two are not the same. Having a loan amendment, it is possible to continue to have a similar home loan and you will financial but with revised terminology. While doing so, you won’t pay fees otherwise settlement costs to change your financing. Likewise, for many who re-finance, you have a separate mortgage you to definitely takes care of the existing mortgage harmony – even in the event additionally, you will have to pay refinance closing costs.

Small deals

In the event your financial are underwater – once you owe on your loan compared to the residence is worth – you might believe an initial income. An initial revenue makes you promote your property for less than it is worthy of, and your financial allows the newest continues of sales just like the repayment of one’s financing, usually in place of you having to put together the entire loan number. When you find yourself a preliminary business usually negatively effect your own credit, the consequences would-be faster dangerous than what you would select which have a property foreclosure on the listing, and you also could also possess some of one’s debt forgiven.