Of a lot financial aid applications and you may special lenders exist to simply help first-time homebuyers pay for a house, whether or not obtained had assets ahead of. Discover more. ( Shutterstock )

If you have never ever owned a property ahead of, or you haven’t possessed possessions in past times 36 months, you can meet the requirements while the a first-day homebuyer. Of many loan providers offer special applications otherwise mortgage brokers geared toward enabling anybody get possessions – considering they meet an effective lender’s first-day homebuyer certification.

Qualifications and you may system positives will vary in accordance with the home loan company and style of financial. For individuals who meet the requirements, you can discover help with things such as the downpayment or closure charges. Particular loan providers likewise have more relaxed requirements, for example a lower life expectancy credit score otherwise income, to possess very first-date customers.

If you find yourself wishing to purchase your first house previously – or very first home from inside the sometime, here’s specific financing advice that could help.

You should always take time to shop around for a mortgage. Credible makes it easy to examine financial cost from multiple lenders.

- What is an initial-time homebuyer?

- Variety of basic-day homebuyer programs

What’s a primary-time homebuyer?

The term “first-day homebuyer” is a bit misleading because it doesn’t invariably mean you’ve never had property just before. In reality, you could potentially be eligible for a first-day homebuyer program even if you performed very own property in past times – provided it actually was over 3 years in the past.

No matter if this really is, officially, your first big date to invest in possessions, this doesn’t mean you will be automatically entitled to one loan applications, thoughmon earliest-day homebuyer qualifications include:

- Advance payment (3% so you can 20%)

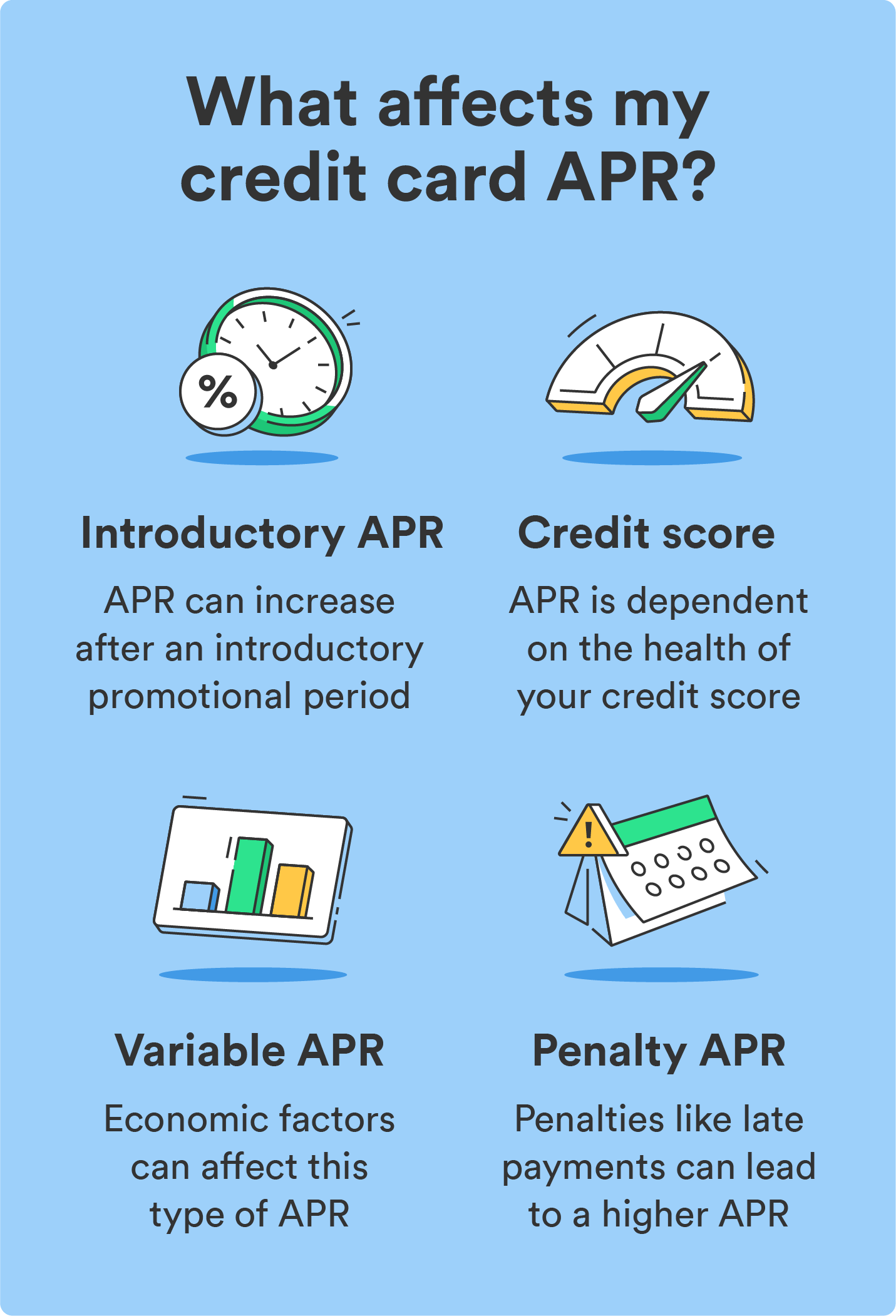

- Minimum credit history (e.g., 500 for FHA loans or 620 for conventional mortgage loans)

- Evidence of earnings (in line with the loan amount)

- 2 or more numerous years of work records

- Limitation obligations-to-income (DTI) proportion (always only about 43%)

Certain mortgage programs has even more qualifications requirements or are only readily available in certain claims, so be sure to take a look at what’s in your neighborhood prior to applying.

Version of earliest-time homebuyer programs

Mortgage brokers do not always publicly highlight the earliest-day homebuyer programs, however, that doesn’t mean they won’t occur. Actually, you may have loads of options to select while in search of let resource the first property. Down payment provides, assistance with closure fees, low-desire lenders, income tax credit and other guidelines should be readily available.

Becoming informed regarding the choice can help you stop a number of an average errors of numerous very first-date homeowners build. It can also enable you to get more experts predicated on your circumstances.

Government loan applications to have first-date customers

The federal government backs particular home loans having earliest-go out people, and also for people who commonly otherwise entitled to an effective mortgagemon authorities-backed software tend to be:

- FHA fund: Insured because of the Federal Homes Management, FHA finance typically have down degree conditions than just old-fashioned mortgages. This makes them simpler to score for very first-go out homeowners otherwise individuals with limited otherwise bad credit record.

- USDA fund: Such federally-supported mortgage brokers are perfect for someone finding purchasing possessions from inside the specific rural elements. There’s no minimal credit rating criteria, even so they would feature specific income and area criteria. These standards usually rely on the brand new condition, home dimensions and you will financial amount.

Down-payment recommendations software (DPAs) are financing and you may provides that can assist that have upfront and you may closing can cost you. They are mostly geared toward basic-go out homeowners.

There are tens of thousands of DPAs from the country, many of which are run by state or otherwise not-for-profit teams. Some individual loan providers also provide all of them, regardless of if.

Qualifications getting a great DPA varies from the state. Quite often, you’ll need to be a primary-time homebuyer, see particular earnings criteria, and rehearse the house or property as your top household. You’ll be able to have to go by way of a specific version of home loan company otherwise mortgage program. Of numerous applications also require at least credit history off 620.

State apps to possess first-go out homeowners

Just like the a first-date homebuyer, you have access to many condition-wide applications, resources and you can incentives. This may involve county property finance agency apps like:

New National Council regarding County Houses Firms features cash loan in Magnolia a listing of the state’s agencies, as well as its very first-go out homebuyer certification and experts. The most common gurus include income tax loans, down-payment and closing fee recommendations, and you will low-interest mortgage loans. Remember that each agencies features its own conditions for income, credit rating, DTI and other requirements.

If you like additional financial assistance or are searching for assist navigating the brand new homebuying techniques, consult with your nation’s Homes and you can Urban Development institution getting resources.

Charity apps

Thousands of charity software can be found to help people pick their very first household. For example, the regional Advice Business out of The united states (NACA) helps reduced- and you may reasonable-earnings people that dont currently very own their house buy possessions in rural otherwise towns. Becoming eligible, you ought to plan to make use of the household as your top household.

A separate charitable system ‘s the Piedmont Property Alliance. That it nonprofit business is serious about and work out homes cheaper as a result of deposit and you may closure prices guidance, plus monetary training.

Instructional software

Certain informative applications, like the Fannie mae HomeView direction, can help first-big date homeowners comprehend the procedure of to acquire and you may buying a home. This type of applications may coach you on towards different varieties of mortgage software, so you can determine the right choice to you.

And also being a free of charge direction, a unique advantageous asset of Federal national mortgage association HomeView, specifically, is that it helps slow down the settlement costs for the specific HomePath attributes up to step 3%.

When you’re experiencing a financial guidelines system otherwise taking an excellent first-day mortgage, you may be expected to just take a particular homebuyer way basic.