The key to Committing to A home

Regarding committing to a residential property, it isn’t chump alter you might be talking about. You prefer thousands of dollars secured for this first resource. Funds to shut includes the fresh check costs, advance payment, settlement costs to pay for charge, and you will pre-paid off taxation and you can insurance rates. Most of these try a rate of price and, hence, vary in proportions.

Precisely how are I doing it? Through learning from your errors initially. I’m just starting to rating my stride, features taken two years. To start with, I was thinking it absolutely was about protecting all of the penny in order that you should buy you to second money spent. The secret one to I have discovered, though, is the fact to create wide range, either you must spend your money.

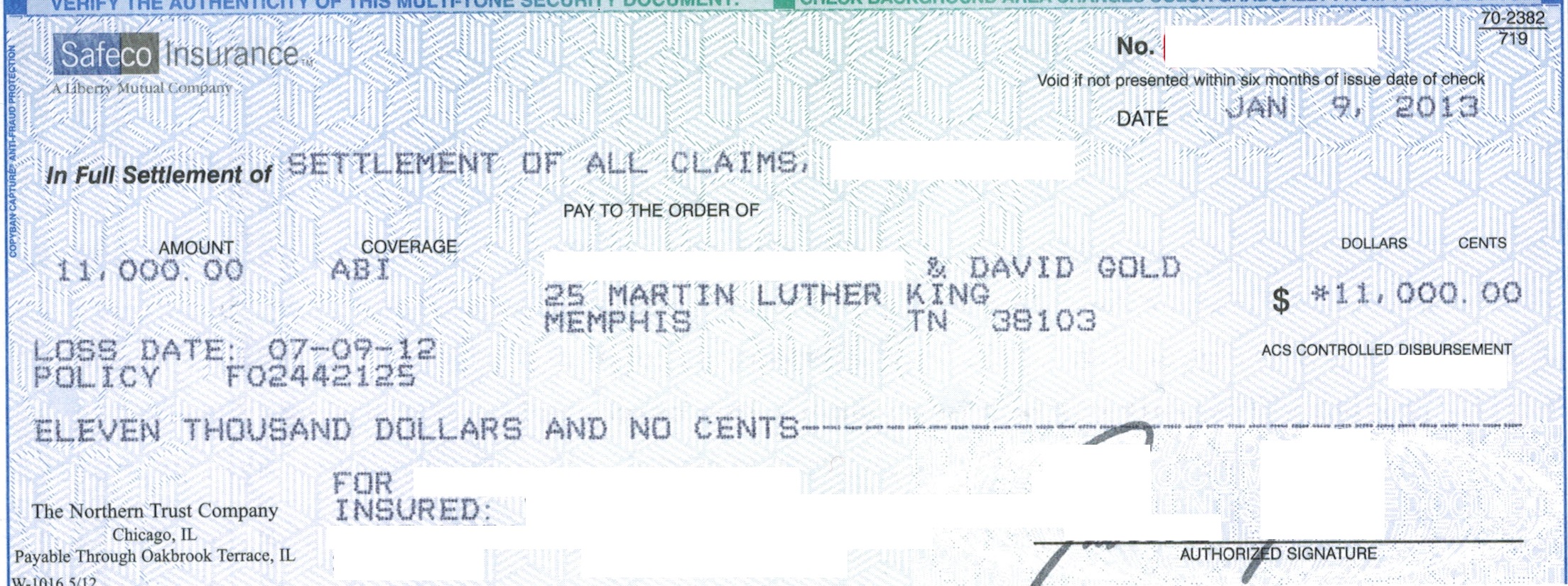

Get, such as, my duplex. I reinvested currency towards assets in order to remove away more cash from the property. An appealing thought processes regarding it, are I correct? Of the putting in a small over $eleven,000 to the cosmetic improvements and you may timing the business right, I was capable of getting the property reappraised for almost $100,000 more I bought they for. Which made me remove my monthly home loan repayments because of the $300/few days and allowed me to sign up for a great HELOC to own $thirty-five,000. Like that, We enhanced my investment of the 3x and you will was able to need to the a different investment that would still assist me generate my a house collection.

What exactly is Good HELOC?

A beneficial HELOC represents household security personal line of credit. Its a personal loan you to leverages the fresh new equity you may have into the an owning a home. By using a good HELOC, your, as a landlord, is also borrow against the fresh new collateral you have during the a house by way of using a second financial. You can use these financing to adopt programs, financial investments, combine loans, or a great many other some thing. This new kicker? The dimensions of the HELOC is based on the degree of collateral you have in your home or property.

Just take, by way of example, my multiple-friends property. You will find a beneficial $35,000 HELOC on that assets. As to why is not it large? While i earliest purchased my personal duplex, I just lay step three.5% down. Immediately following and also make makeup status to my duplex and you will viewing the newest appraised philosophy from a home increase over https://paydayloansconnecticut.com/pleasant-valley/ the years, I had my personal property reappraised adjust regarding a keen FHA financing to a conventional loan, which may sooner or later allow me to shed my personal dominant mortgage insurance coverage (PMI). The excess collateral, in principle, that had been paid (otherwise, in this situation, appraised high) you’ll upcoming be employed towards a good HELOC.

Guess The degree of Your HELOC

As with any loans, for every lender features other rules regarding financing. For this reason its HELOC providing might look a bit some other. Eventually, lenders will likely allow you to acquire a specific payment of your security in your home. To help you imagine just what one to count might possibly be, everything you need to create is actually bring your appraised worthy of/cost and subtract the loan equilibrium.

From that point, might proliferate this new commission they are ready to loan your for the collateral of your property. So it following will get the second financial. I would recommend your consult your financing administrator/lending company to possess a great HELOC recommendation, along with do a bit of look your self. This way you never limit your choices and are usually ready to optimize how big is the HELOC.

Could it possibly be Wise to Explore Good HELOC To spend?

The great thing about a HELOC is that you have not to touch it. It could be here in the event you want to buy regarding coming, just as a back-up, or leveraged to have a particular goal such as for instance a married relationship. Personally place a HELOC in position inside the spring season out-of 2020 as the I found myself concerned with this new housing market and you will and also make a living. By using my duplex while the a secured asset, I became able to safer a credit line through the entry to a good HELOC just like the a backup. Fast toward 2021, which HELOC will be employed to security particular of my personal opportunity costs.

One more reason I love HELOCs is because they normally are given having seemingly comparable interest rates to help you lenders with little to no to zero closing costs. It personal line of credit interest rate tends to be less than personal loans and certainly will getting very useful whenever wanting specific brief bucks to own a remodelling (otherwise a few). You will find basically no pre-fee penalty while you are capable pay the bucks very early, and it may be used over repeatedly (as long as the money was basically rejuvenated). Additionally, unexploited finance incur zero focus costs.

How to remember a good HELOC feels like a beneficial credit card. You could potentially borrow money from it, repay it, right after which borrow cash from it once more. You may have a threshold, and you have to invest focus for the funds you borrowed otherwise utilized. The main benefit although was credit cards are apt to have twice fist rates, if you’re HELOC’s right now () shall be secure to own between 3%-5%.