Exactly how much home loan do i need to get on my personal income? If you’re a good salaried personnel and also you want to individual a property, this is basically the earliest concern you to comes up at heart. This short article explain to you what section of their paycheck represents if you’re figuring qualifications, which are the preferred income slabs & their eligibility number, which are the other variables affecting your qualification and finally exactly how effortless it is to try to get a mortgage.

To buy your own house try a major action for many people when you look at the reaching a sense of settledness. This might be especially a position part of Indian people. However, for many the new salaried inhabitants, a residential property prices are beyond the visited. Only after faithfully strengthening their discounts can they fundamentally get this fantasy an actuality, usually afterwards in life. This is where availing off a home loan can also be catapult oneself to reach their homeownership dream while very young.

Learn their salary:

Estimating salaries is also cover playing with data symbolizing both terrible or internet (in-hand) salary. Ergo, it is very important comprehend the difference in gross and you can web paycheck. This is because monetary education often think about the web component of a person’s paycheck while going to their house mortgage qualifications. Salary build changes all over certain communities. not, it is generally split into another elements:

- Earliest Paycheck

- Allowances For example Scientific Allotment, Log off Travel Allowance (LTA), Family Book Allowance (HRA), Almost every other Allowances, etc.

The aforementioned portion function the newest gross part of the income. not, this is not the very last count the employee takes house. There are a few required deductions from the gross overall. Speaking of deductions into the Personnel Provident Loans (EPF), Tax Deduction in the Provider (TDS), Top-notch Taxation, etc. Brand new write-offs done, the remaining matter constitutes the net paycheck, and therefore professionals can be call its within the-hands pay or salary. Financial qualification computation takes into account an enthusiastic applicant’s web paycheck near to other things.

How much cash Home loan Should i Get on My Paycheck?

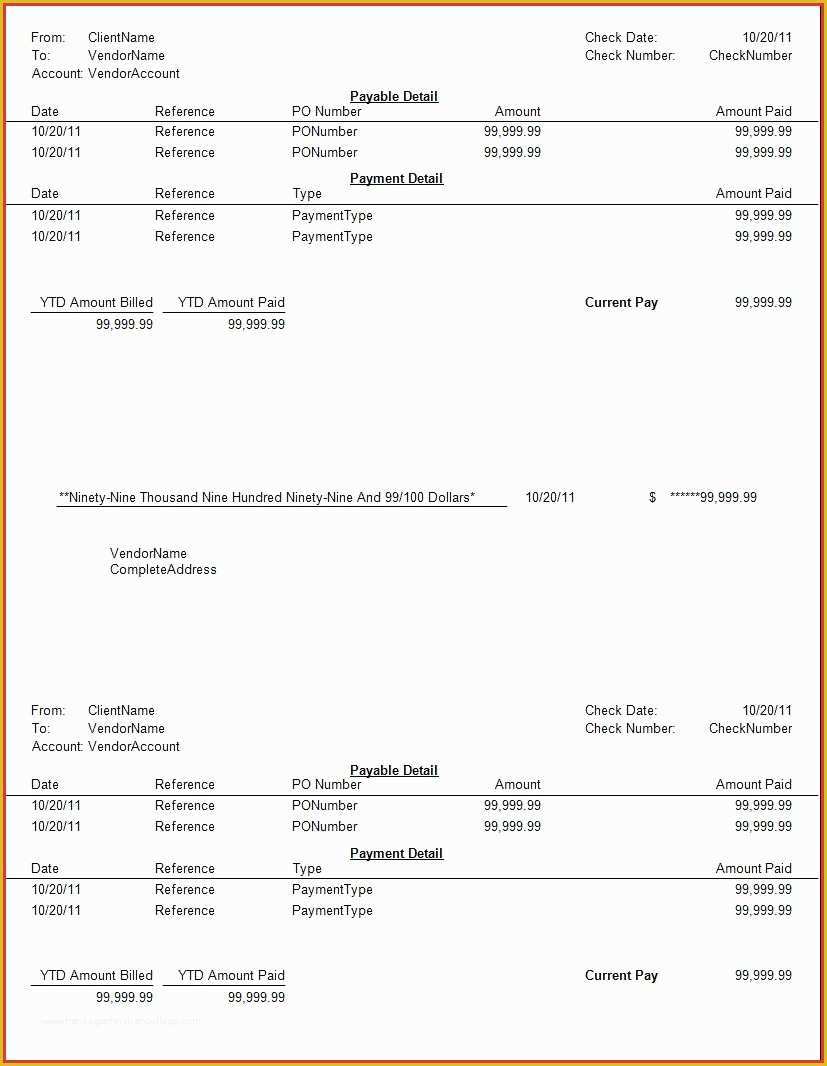

Usually away from thumb, salaried people are permitted get home money up to up to sixty times its net month-to-month earnings. So, in case the net month-to-month paycheck are ?forty,000, you can buy a home loan around approximately ?24 lakh. Likewise, for people who earn ?thirty five,000 30 days, you can aquire approximately up to ?21 lakh. An accurate technique for going to qualification has been good financial eligibility calculator which will take under consideration other things aside from websites month-to-month money. Having a simple source, i’ve detailed down popular online month-to-month income slabs as well as their corresponding count qualifications. These thinking were computed with the HomeFirst Mortgage Qualification calculator assuming the next criteria:

Note: When there is more step 1 generating representative when you look at the a family, the online monthly income of the many earning professionals are joint to get to a high financial qualification number.

Other variables Impacting Financial Qualifications:

- Age: Lenders are around for candidates ranging from 21 to help you 55 ages of age, however, essentially, financial institutes prefer to approve mortgage brokers on the younger people. This is because young individuals has a longer working existence. For this reason, the likelihood of repayment off mortgage brokers was higher. On the 50s, you to ount as well as for a smaller years.

- Company and you can Functions Experience: Some one in a respected company will rating a mortgage since they are reported to be safer. This gives count on off prompt payment away from EMIs. In addition, if you’re working in a reputed team, then you may qualify when planning on taking increased amount opposed in order to anyone handling not too reputed business in the event that any kind of items are thought equal. Furthermore, your work feel speaks much concerning your balances and you will serves as the an optimistic tip in your application.

- Credit history: Among the essential activities when you look at the choosing your qualifications is your prior percentage track record of funds and that is seized by credit history . Even although you secure a very handsome paycheck, a dismal credit get normally negatively impact your odds of delivering a home loan. Fundamentally, monetary schools prefer a credit score of more than 650. A credit score significantly more than 750 can also give you an upper give so you’re able to package to own all the way down mortgage interest rates.

- Established Loans (also known as Fixed Obligations so you’re able to Earnings Ratio otherwise FOIR): Financial schools started to mortgage number qualification out-of a man only after looking at the present loans about the EMIs and you may outstanding fees from most other funds which they possess availed eg a car loan, individual strong mortgage, personal bank loan, credit cards, etc. Loan providers prioritize in control credit means, for this reason it evaluate web income to ensure down costs and you may EMI for mortgage borrowers. FOIR is the portion of the sum All Existing Month-to-month Personal debt so you’re able to one’s websites monthly earnings. Normally, it ought to be less than fifty% getting qualifications.

- LTV (Financing to Well worth): Even if you provides a higher financial qualifications in terms of one’s web monthly earnings, economic education merely money around 75% in order to ninety% of the total cost of the property. This is done to make certain he’s got enough shield in order to liquidate the root house & recover the matter in the eventuality of a default.

- Property’s Judge & Technical Recognition: With regards to home loans, wellness of your own hidden resource is very important. https://paydayloancolorado.net/alamosa-east/ Monetary Schools features 2 chief evaluation requirements into the property you to definitely the latest candidate is just about to purchase. The first a person is to look at the fresh new legal strings of assets to determine a very clear name & possession as well as the next one is to determine the market value of the property. Both these reviews are generally done-by independent solicitors & valuers that happen to be appointed by you to definitely financial institute.

Sign up for Financial:

In advance of introducing a search for the new fantasy household, you have particular idea regarding the financial matter you could be entitled to based on the paycheck. It will help for making a financial choice concerning assets you intend to get. You should check your house financing qualification calculator in order to assess just how far count youre eligible to get. Due to the fact home is closed, you can visit new HomeFirst website and you will fill the brand new inquiry function to receive a visit back from our Counsellors. You could potentially refer this article to learn more and more mortgage terms and conditions or this post having documents you’ll need for financial software

To your a lot more than guidance in place, one can possibly answer comprehensively the question off simply how much house loan you to log on to their/their particular income. This helps all of them bring a massive action to the buying the dream household.