Since the a healthcare professional, you invested hours and hours in your knowledge and you may knowledge. That it partnership have a tendency to includes high economic sacrifices, particularly student loan obligations. While you are the peers was indeed doing work, saving, and you can racking up money, your own attract might have been on your education and you can degree. With these installing challenges, the thought of to find property seems like a faraway opportunity, particularly when you think about the standard mortgage conditions. not, discover a unique economic provider only available for people like you medical resident mortgages.

Just what are Scientific Resident Mortgages?

Medical citizen mortgages was another type of version of financial equipment designed towards specific monetary circumstances out-of physicians, for example those who work in early stages of its work. These types of financing are created to complement physicians just who, even with a high obligations-to-income ratio, are needed getting a premier money later. Let’s diving inside the and you may discuss the method such financing work, their benefits, and you will possible disadvantages.

Novel Challenges to own Doctors

Educational Obligations: Very doctors face a high debt burden. According to Connection away from American Medical Colleges (AAMC), the newest median four-season cost of attendance in the a community scientific school is actually $250,222, and you can $330,180 from the a personal organization. The interest pricing to possess student loans can be as large since 6.28% getting federal Direct Along with loans or as much as 12% for the majority individual fund. Which obligations can add up over time, specially when lowest earnings-created costs are manufactured.

Reduced First Income: While medical professionals come into education, its income can often be restricted compared to the the future generating possible. This leads to a top financial obligation-to-income ratio, so it’s problematic for physicians so you’re able to qualify for traditional mortgage financing.

Just how Old-fashioned Mortgage loans Functions

Old-fashioned mortgages come under several kinds: compliant fund and you will non-conforming finance. Conforming fund comply with a particular money limitation place because of the Federal Construction Finance Company, while low-conforming financing exceed this type of limits otherwise dont see almost every other conditions.

Off Costs: Traditional finance need a deposit, commonly indicated as a portion of one’s cost. Check out this illustration of the down payment deals with a normal mortgage: In the event the domestic we wish to buy will cost you $800,000 as well as the advance payment requirements is actually ten%, you would certainly be needed to keeps a deposit away from $80,000. An average of, down repayments to possess household sales in the united states is approximately 12%.

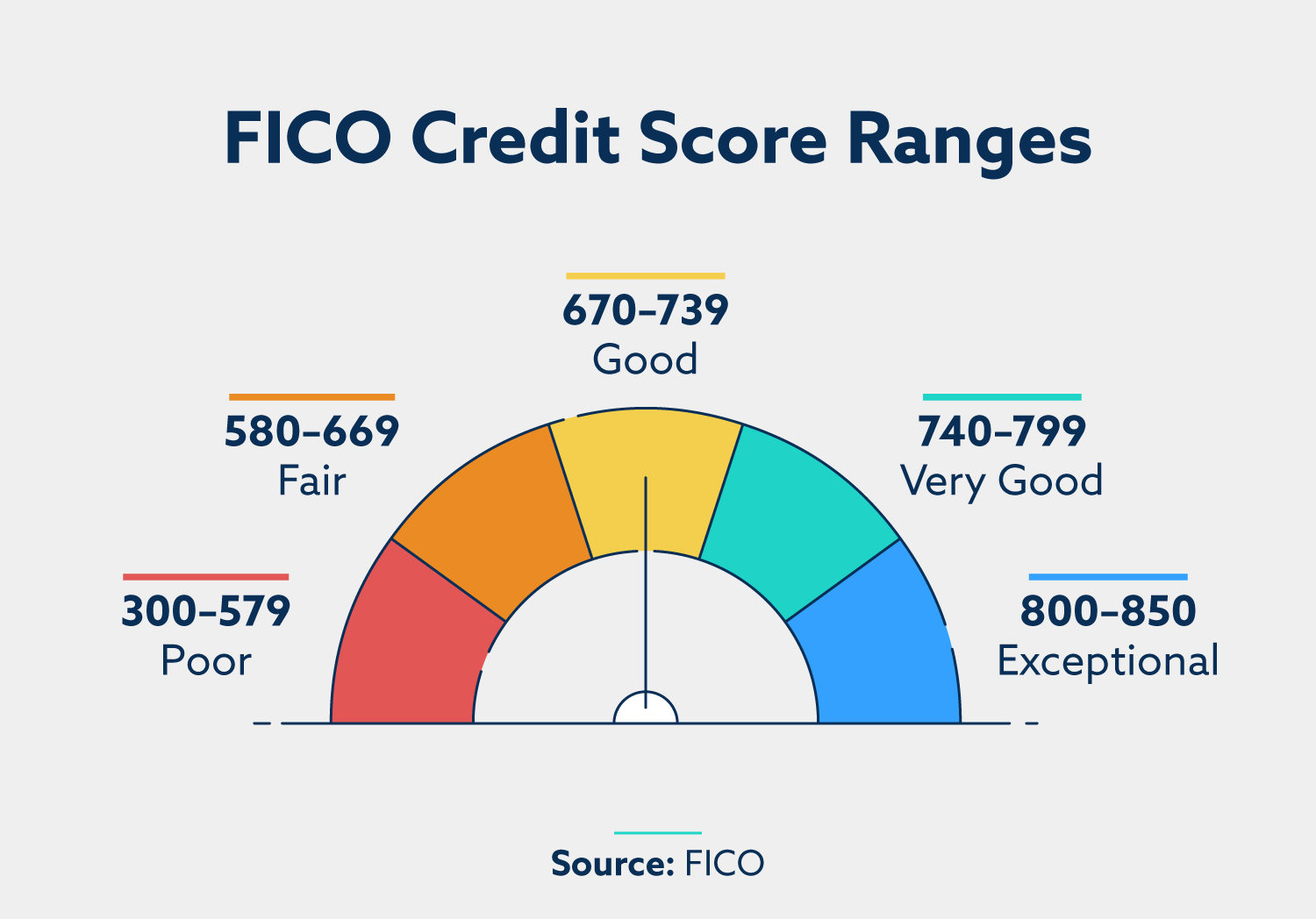

Credit rating and Financial obligation-to-Money Ratio: Being qualified for a normal financial typically need a credit score significantly more than 620 and you will an obligations-to-money proportion that is lower than fifty%.

Benefits of Resident Mortgage loans

Zero Advance payment without PMI: More benefits element away from a health care professional home mortgage is the likelihood of 0% deposit without any dependence on Individual Home loan Insurance (PMI). This allows you to definitely use your own deals elsewhere, online payday loan New York particularly using otherwise paying large-desire debt.

Smoother Certification Processes: Lenders offering physician fund see the novel financial products off medical experts. They accommodate increased debt-to-earnings ratio and don’t were education loan repayments regarding computation.

Higher Mortgage Limits: Physician funds normally have higher limits than just traditional money, generally speaking $one million getting 95-100% funding, otherwise $dos million to possess ninety% funding. This enables toward purchase of more substantial or maybe more costly household.

Cons from Resident Mortgages

Large Rates of interest: Doctor funds essentially hold a top interest than just old-fashioned money. Over the course of a 30-seasons home loan, so it change can lead to significant will set you back.

Limited Possessions Versions: Doctor money is actually limited by most of your residence. Services such as for instance trips property, second belongings, condos, townhouses, otherwise investment features may well not meet the requirements.

Should you decide Go for a healthcare Resident Home loan?

Just like the potential for home ownership no down-payment may seem like a pretty wise solution, it is necessary to consider carefully your financial situation and you can community requirements. You can also want to rescue getting a far more big down payment and apply to own a conventional financing whenever you are more economically secure. To help you describe the entire process of watching in the event that a health care provider home loan was best for you, focus on a broker out-of physician mortgages, particularly LeverageRx. A broker normally connect your with lenders who’ll provide you with with a doctor home loan centered on your unique disease

If you’re doctor money is a suitable choice for of many doctors, there are other real estate loan sizes to consider. FHA money, Virtual assistant money to possess army provider players, and you can USDA fund having outlying town functions the features their particular masters.

Key Takeaways

Scientific resident mortgages give an opportunity for early-career medical professionals to become property owners. Yet not, these finance go along with high will cost you eventually. Be sure to consider carefully your financial situation, occupation goals, and private thinking before making a decision to the right mortgage option. Coping with a health care professional mortgage broker such as for instance LeverageRx can considerably express the search for your future mortgage.