The fresh new FHA (Government Construction Administration) financing is a great means for Illinois people to order a beneficial house. Whether you’re purchasing your basic home otherwise six th domestic, getting an enthusiastic FHA loan helps you get to homeownership which have several advantages.

Illinois FHA Funds Render Easy Borrowing Standards

Typically, the credit criteria having obtaining an enthusiastic FHA mortgage within the Illinois is actually less restrictive as compared to conventional mortgage legislation. This enables individuals with limited credit history, or even some earlier in the day blemishes, to qualify for an enthusiastic FHA loan. If you are a conventional home loan will often want the very least credit get dependence on 740 or more in order to be eligible for a knowledgeable terms, FHA home loans are approved with an incredible number of five hundred otherwise over.

On eyes regarding FHA, initial aspect of someone’s credit score is the latest several-few days mortgage repayment listing. If your last 1 year show that a person can fulfill almost all their debt promptly instead resorting to borrowing a lot more currency, that’s always an indicator the person is prepared to deal with homeownership.

Money Files

While the federal government guaranteed the newest FHA loan program, we offer a good display away from documentation conditions. If you discover an excellent W-2 form annually, the following list is short for exactly what will be needed people in order to prove your revenue

- Your pay stubs from the company. You truly need to have pay stubs level at the least the very last 30 diary months. Additional paystubs is asked based on how far-out new closure go out is actually.

- Their W-2 variations out-of at the very least going back 24 months

- Your own government income tax returns during the last 2 years which have all times

- Your own government tax returns the past couple of years

- Your own businesses government tax statements going back 24 months

- Profit-and-loss report about 1 st of the season from the app time

Based on your unique situation your loan manager could possibly get ask you to answer to find out more. Expect you’ll timely show all of your financial data files in order to the borrowed funds bank to save the mortgage techniques moving with each other.

As well as proving your own actual money, the lending company commonly make sure employment to be sure you have been continuously employed for the final 24 months. Even though it is okay to change services, make sure that you was building your self with a brand new workplace which there are no unexplained openings in your really works listing.

First House Simply

The fresh Illinois FHA home loan is perfect for people that have a tendency to inhabit the home as his or americash loans Lanett her primary home. FHA doesn’t mortgage currency to have trips land or local rental properties.

Yet not, the FHA program was flexible towards types of assets you to definitely you get. While you are a stick-situated, single-home is among the most popular assets funded through an enthusiastic FHA-covered financial, there are many more form of qualities entitled to financing. The ensuing list suggests the sort of land one FHA have a tendency to imagine money:

- Single-house

- Duplex (you should reside in you to definitely point. You could potentially rent out the other part)

- Three-device (you ought to are now living in that part. You might book the other areas)

When you’re an apartment would be recognized having FHA funding, it will require a tad bit more files. Depending on be it a freshly developed condominium or a good pre-existing condominium commonly dictate and therefore assistance must be came across. Their FHA bank can take you step-by-step through these tips that assist you know if the latest condo is approved getting an enthusiastic FHA home loan financing.

Documenting The Down payment

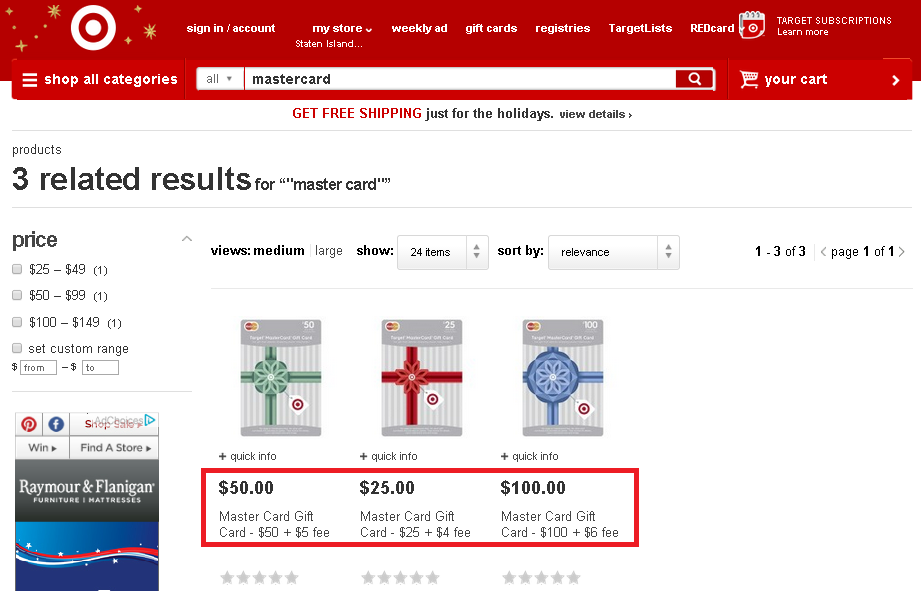

The fresh new FHA laws declare that one to get a house inside Illinois need to pay no less than a tiny downpayment out-of 3.5 per cent of home’s price as a deposit. It indicates, particularly, that a person purchasing property inside Illinois costing $200,000 would have to spend $eight,000 on closure into advance payment.

FHA also has a nice ability that will help many first-day homeowners during the Illinois. The bucks useful the downpayment can be a present out of a relative otherwise significant other. For the provide is invited, you and new relative will need to create copies of one’s bank account. An excellent 60-day paper walk demonstrating in which the money had been withdrawn from and you can transferred will be required. You ought to including write a quick letter explaining your money is something special rather than anticipated to be repaid.

Non-Occupying Co-Borrower can be found Also!

You to items one to appears to stop people from purchasing a house is their personal debt-to-income ratio. For example need or other, a guy appears to have too-much personal debt in writing so you’re able to qualify a beneficial chance for a home loan. The fresh low-occupying co-borrower alternative facilitate dump which burden.

FHA enables someone to co-sign up a mortgage in place of requiring anyone to reside your house. This permits a close relative that have a solid earnings to greatly help aside a young cousin within trip buying property.

FHA will allow that it circumstance as long as there’s a good lead family relations family inside. Most instances encompass a grandfather otherwise grandparent providing aside their child or granddaughter. Sisters can also help other sisters.

As long as the main consumers plus the low-occupying co-individuals meet up with the borrowing from the bank advice and you will financial obligation-to-earnings percentages given that a combined group, there should be no problem having the mortgage acknowledged.

2024 FHA Loan Limits into the Illinois

Discover top constraints to own Illinois homebuyers into limitation amount borrowed designed for FHA loans. Land costing otherwise below the restrictions can be qualified to receive capital. Certain specific areas of the condition used to have high mortgage limitations due to the full economic fitness of city. But not, in 2010 there aren’t any highest limits to have 2024 in every of one’s areas within the Illinois.

*step three.5% downpayment centered on $193,000, 4.125% / 5.713% Annual percentage rate, 30-year fixed rate of interest financial. Individual Mortgage insurance policy is expected. Costs are subject to change. Subject to borrowing acceptance.