A jumbo loan ec-fsc-label-2024 could possibly be the key to the home of their ambitions. Jumbo mortgages have aided tens and thousands of People in the us get land with highest price tags. But they as well as hold some special criteria. Towards the top of it checklist is big deposit. If you’re considering good jumbo mortgage, you can inquire what kind of cash you should put down. You may want to need to know how to begin rescuing for your deposit.

Typically out-of thumb, you will definitely generate a down payment with a minimum of 10% on your jumbo financing. Some lenders may need the absolute minimum downpayment from 25%, otherwise 30%. When you are an effective 20% down-payment is a great benchmark, it is advisable to speak to your financial regarding the every choice.

Luckily for us you don’t have to become restricted to these types of data, you might be free to create an amount large down-payment for many who wanna. By creating a larger down-payment, the overall financing might be quicker along with your month-to-month mortgage repayments is down.

Exactly why are jumbo loan off costs a little while bigger than mediocre?

The idea of picking out a six-contour downpayment would be a bit daunting, particularly if you will be an initial-big date homebuyer. To understand as to the reasons a more impressive down payment is oftentimes requisite, set your self about lender’s shoes. Jumbo money pose increased risk to help you loan providers than just conforming money. Discover about three first items you to join that it higher risk:

- Mortgage wide variety try big. Jumbo loans initiate at between $766,501 to $step 1,149,826 based area.

- They are certainly not guaranteed. Jumbo financing aren’t insured by the FHA otherwise owned by Fannie Mae and you may Freddie Mac computer. That it sets loan providers in the enhanced chance to have loss.

- Losings try better. More funds try a part of jumbo financing. For those who standard towards an excellent jumbo financing, the loss is big for your lender.

While the markets can transform and you can dangers are high, never assume all finance companies otherwise loan providers render jumbo funds. Thankfully, there are still certain better-situated banking companies who will be able to give jumbo mortgages out of up to help you $step 3 billion or maybe more.

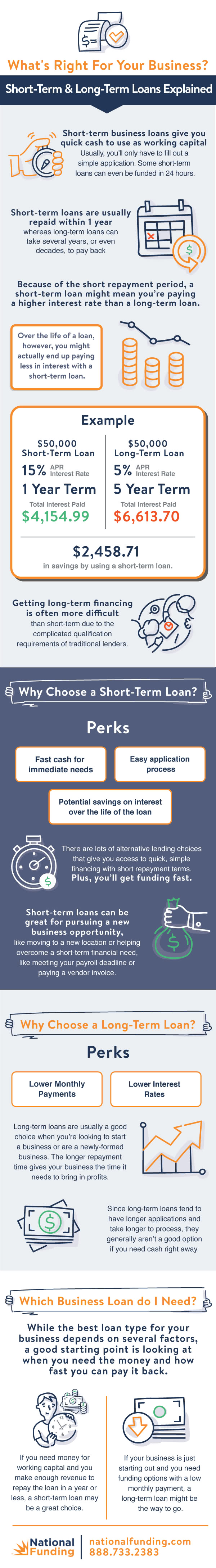

You’ll be able to see a lender who can accept a faster advance payment. But if you see a loan provider whom also provides good jumbo mortgage in just 10% down, be sure to browse the conditions and terms on your own financing contract before signing they. More often than not, an inferior downpayment may result in another:

- Higher monthly premiums

- Increased interest rate

An experienced House Financing Coach normally remark the pros and downsides off a lowered advance payment along with you. Capable together with show you just how less deposit can impact your own monthly premiums. For almost all buyers, the prospect out of huge monthly premiums should be inspiration to be hired with the saving getting a much bigger advance payment.

How exactly to conserve for your down payment

Once you learn the amount of money you should set out, it is time to examine your earnings. Ideally, you’ll actually have currency protected for your down-payment. However,, when you are like other consumers, you may need to create a few economic adjustments. Thankfully, there are many different an approach to fund a down-payment. Without having sufficient currency currently protected, listed below are three choices to assist gather the deposit:

step 1. Make use of the earnings you make Maine personal loans about income of one’s existing domestic

If you find yourself getting ready to sell your current domestic, you could use one profit you make into the downpayment to suit your new house. Although this means would not benefit very first-date homebuyers, it may be a powerful way to build bucks to suit your deposit.

dos. Tap into your own bank account

If you were a diligent saver historically, you may also contemplate using their savings account to cover the downpayment. Ensure that you go-ahead which have warning if you decide to use this method, since your bank will likely need you to has actually finance remaining following the pick in case an urgent situation affects.

3. Increase money

It sounds noticeable, although more cash you will be making, the faster you can save to suit your down payment. A terrific way to begin is always to speak to your company regarding the chances of an increase. You’ll be able to give to consider special methods otherwise functions overtime for extra income. For folks who strike out together with your workplace, you can test a moment business if you possess the resources in order to spend on region-go out a job.

Most other jumbo mortgage costs

Coming up with the cash to suit your down payment try an excellent higher fulfillment. But don’t disregard you can find so much more can cost you it’s also possible to need to defense. One which just move ahead having an excellent jumbo loan, be sure to has savings to fund settlement costs and other loan-associated expenditures. Here are some prominent closure-relevant can cost you:

- Assessment percentage: Family appraisals can cost several hundred or so bucks. Given that jumbo loans may need a couple appraisals, you ought to want to shell out twice as much.

- Domestic evaluation payment: A home inspection can cost $two hundred so you’re able to $five-hundred (PDF) depending on their property’s dimensions, venue and range regarding review.

- Bucks set aside requirements: Some loan providers need you to keeps at the least 1 year of mortgage payments readily available.

- Lawyer costs: If you opt to has legal symbolization from the closure, you will need to safeguards attorney costs.

Although this directory of will cost you is a lot available, dont feel weighed down. Your own financial will offer you financing Imagine that number every costs you may be needed to shell out. By doing this you will have a very clear knowledge of this new fees you happen to be spending.

Try an effective jumbo mortgage suitable for myself?

At the end of the afternoon, jumbo financing cover even more dangers to own buyers and you may loan providers. If you’re not sure if you ought to get an excellent jumbo financing, the best thing accomplish was talk to a experienced Household Lending Advisers. When you meet with our lending pros, we offer the second:

A jumbo home loan will be your gateway to the house you’ve come dreaming out of. But you will should make a large advance payment to the greatest from closing costs or any other loan costs. Start by playing with a home loan calculator while making an informed decision about the financing for your individual need.