Regarding affordable loan situations, that usually decides between a home guarantee financing otherwise your own loan. Anyway, these products are a couple of guaranteed means to the borrower doing its chief desires.

- Paying off credit card debt

- Relationship costs

- House remodelling

- Scientific costs

- To invest in a car

While it’s depending that getting a house collateral loan otherwise a good unsecured loan are one another feasible choice, how can you learn that’s right for you and your financial predicament?

Let us check a number of the high distinctions between them financing, so that you enjoys a better thought of and therefore financing is most beneficial for your certain situations!

What exactly is a property Equity Loan?

A property collateral mortgage is a kind of shielded financing that leverages their residence’s guarantee (the expose ount) because collateral. Your property equity try an asset given that unlocking it enables you to definitely borrow a cost that is equivalent to otherwise upwards towards the worth of domestic.

You reside currently valued during the RM600,000. Bear in mind, yet not, the limitation mortgage margin you might be permitted to obtain otherwise re-finance was 80% of home’s value, which is RM480,000. In this case, you will still owe RM300,000 home loan. As such, you would be capable obtain property security financing out-of:

How come a property Security Mortgage Functions?

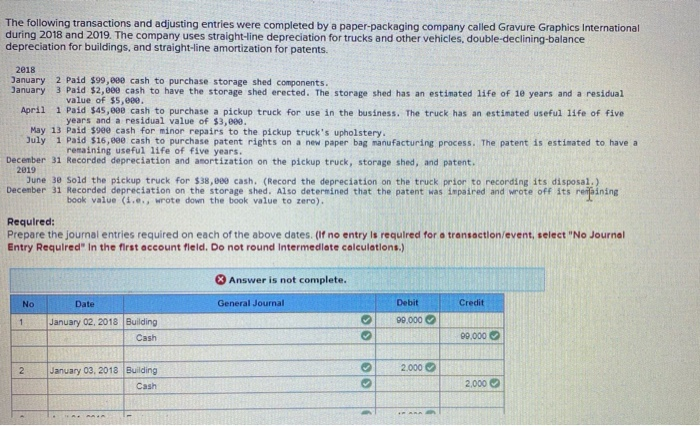

You’ll be qualified to receive a house collateral financing if you have sufficient equity in your assets and you can a good credit score. After that you can make an application for a home collateral loan using your bank. Keep in mind you can easily likely need to pay certain courtroom otherwise processing charges.

Thus, it is required to contrast rates between certain banking companies because they may waive this type of most will set you back. It’s also wise to get a hold of hence lender will bring a loan amount you to provides your position and you will an installment term in addition to mortgage loan that meets your allowance.

Whenever Ought i Prefer a home Collateral Loan?

You might choose for a property collateral financing if you’re not qualified to receive a decreased-attention personal bank loan but have enough home equity. Once accepted, the mortgage is generally offered in the way of the next financial, paid in one lump sum, and you are clearly responsible for repaying interest on full balance.

Domestic guarantee finance bring all the way down interest rates than just unsecured loans while the they utilise your house just like the equity. Also, you could subtract people focus paid down towards the property collateral financing from your taxes if you use money getting a house repair otherwise upgrade opportunity, that is not you’ll be able to which have a personal loan.

However, definitely generate towards-big date payments. That with your property equity to help you borrow cash, you happen to be fundamentally putting your house at stake. This means that incapacity to help you oblige into lender’s terminology and requirements may lead to the increasing loss of your home!

What is a personal loan?

When you are family collateral funds is secured by security you have put up of your home, personal loans is actually thought to be signature loans because they are backed by little. Alternatively, what you can do to track down a personal loan is decided generally by the your earnings and credit score.

Compared to domestic equity loans, signature loans bad credit personal loans Nevada enjoys highest interest rates and their unsecured characteristics. On the other hand, getting a personal bank loan might be rather shorter than simply getting an excellent home security mortgage because your possessions actually put because the equity, therefore requires much easier methods.

Why does a personal bank loan Works?

Dependent on their bank, choosing recognition or getting rejected for your consumer loan software can take each week if not as quickly as a few momemts. Once authorised, the lender will deposit the funds to your bank account as the a single payment, usually contained in this a few days.