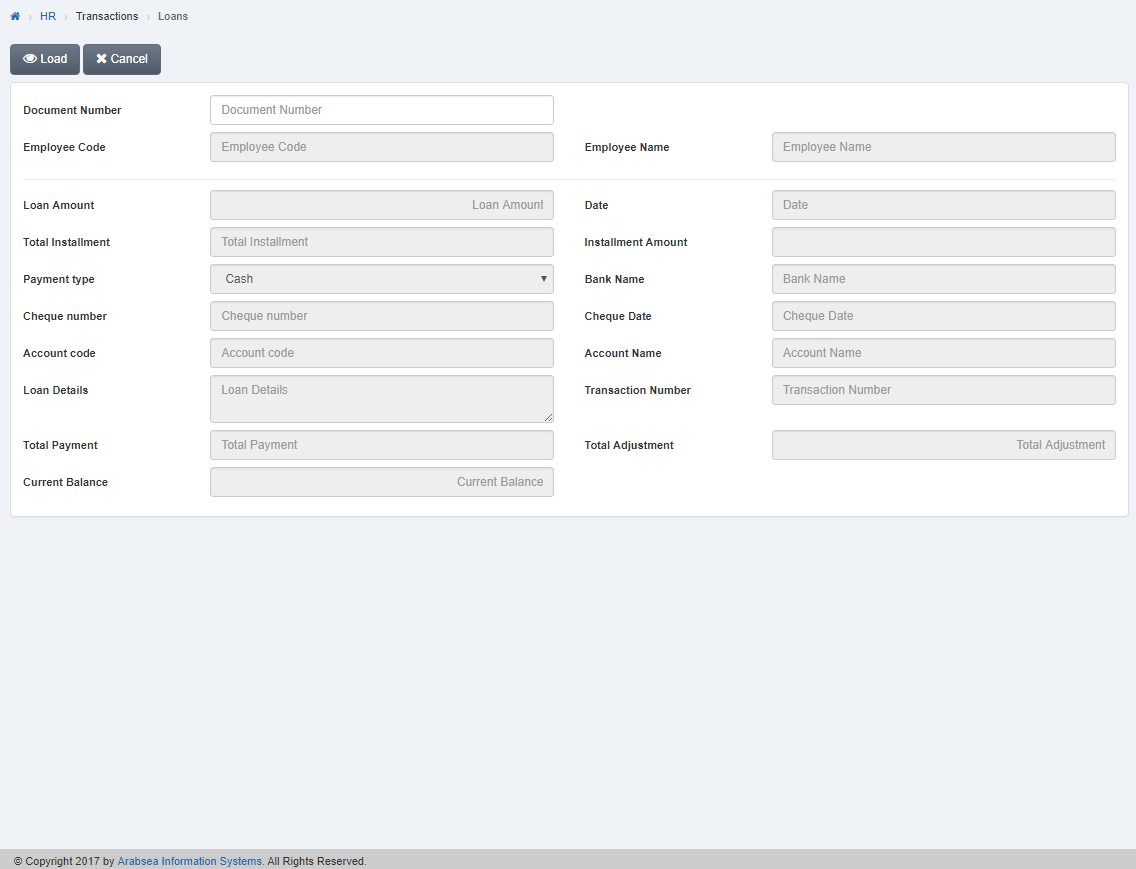

Such-like Dave Ramsey’s writings web page, it reveals just how much house we could pay for. Therefore following that, he’s going to walk through specific similar things. So you may be accumulated your complete monthly income, proliferate it from the twenty-five%. When you set up there your own month-to-month get-home pay plus one manner in which you certainly can do this is exactly because of the looking at your pay stubs for the past times and you will see what’s your own mediocre simply take-house spend since it is probably adjustable, it’s may possibly not be an equivalent, however, why don’t we work at you to definitely scenario.

Imagine if you make $4,000 a month tame domestic. And we also you’ll estimate, we can comprehend the limitation home loan number is actually $step one,000 four weeks. Therefore considering an effective cuatro% interest rate toward a good 15-season repaired financial, you can certainly do good $150,000 home with ten% off, good 168, 990 which have 20%. And you may find it rises since you put even more money off.

Why is it a indicates?

So now one to begs the question, is this helpful advice? Sure. The latest short answer is yes. This new much time response is it is challenging since it is tough guidance. This really is strong financial pointers and you may strong monetary experience as https://cashadvancecompass.com/loans/dental-loans-for-implants/ the which have Dave Ramsey is attempting to educate we have found a lifestyle you to is very counterintuitive about what we have been usually familiar with. Particularly in The united states in which we have been really used to carrying personal debt and you can and also make repayments. And it is an easy task to have the therapy that we always need to make costs to your one thing.

Your property as a blessing

Exactly what Dave Ramsey was indicating here is removing personal debt earliest, to ensure a property gets a true blessing. He talks about most of the thought of when you find yourself providing a house, you desire you to where you can find be a true blessing.

Leasing was to purchase patience

And if you are leasing isnt wasting currency such as for instance anyone wishes to express. That’s an impartial view for my situation while the I return when people purchase property, and i also cannot profit when individuals rent. But it requires a great deal for an individual in the a house world to state leasing actually is perhaps not wasting currency. Exactly what Dave Ramsey phone calls it is to order patience.

So if you’re leasing high, you happen to be purchasing persistence if you don’t have the ability to get there. However need one to household is something was productive. That’s a true blessing for you which makes lifetime most useful and you may which you adore it. If you don’t, it really is going to be a weight. By using into the really regarding a casing fee that you can not manage it later.

Including, keep in mind that it is a rather traditional view. Just what Dave Ramsey really does due to each one of his monetary suggestions was extremely conservative. It is a rather smart riches-strengthening approach that works perfectly over time, but they’ve been old-fashioned preparations. There are more plans which could fit you.

If you’d like Dave Ramsey, I am a big enthusiast of Dave Ramsey. This can be a beneficial strategy for you to get into the, and it’s browsing establish you for achievement long-term since the what can happen is you might feel like this is certainly too rigid on how to choose the domestic that you like. Of course so, it’s really there to protect you to definitely put guardrails on the coming.

In order to buy the house now you possess making specific sacrifices, but over the years, that is going to help you by assisting you in order to have alot more safety rather than normally financial obligation otherwise exposure otherwise duty you have to take on tomorrow.

Win Our house You like LLC, a training business. Victory Our home You like LLC is not a loan provider, doesn’t thing mortgage qualifications, and will not extend borrowing from the bank of any kind. This amazing site is to own instructional usage. All data can be verified independently. This website isnt an offer in order to provide and cannot actually be used to generate conclusion to your family now offers, buying conclusion, neither loan alternatives. Perhaps not going to provide appropriate abilities, mean financing terminology, qualification quantity, neither real estate recommendations. Find guidance of an authorized realtor, mortgage founder, economic planner, accountant, and/otherwise attorneys for real estate, legal, and/or monetary information.