This new fourth one-fourth will bring a more inviting ecosystem having home loan rates downtrending – utilizing the Government Reserve’s larger Sep cut – reducing household price increases, and growing directory. In most of the nation, it will be the top time to get a home.

Getting wishing are a major key to are a citizen. So are talking to people in the discover. The mortgage Accounts talked that have six skillfully developed to see just what guidance they had share with basic-go out home buyers going on the 2025.

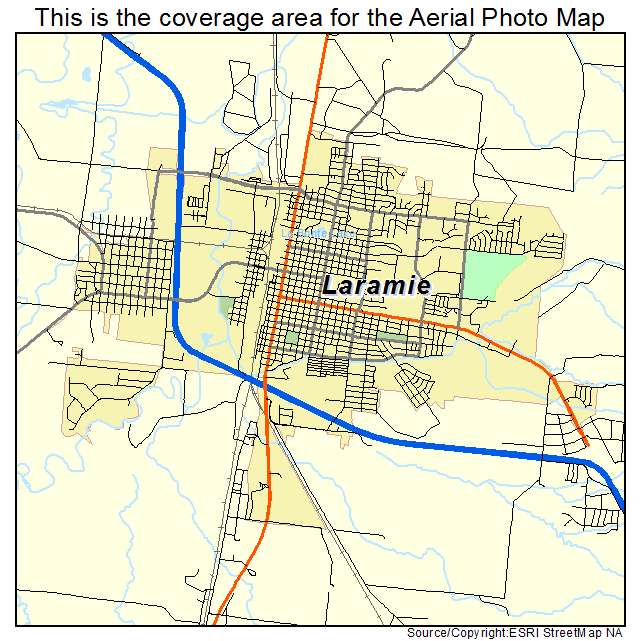

Real estate requirements have a constant state regarding flux, shifting over the years and also by topography

To get rid of certain light and (hopefully) make issues simpler, The mortgage Accounts got facts off six experts in the field to assist borrowers regarding the 4th quarter. Solutions was indeed modified to have brevity and clarity.

Since mid-2020s we’ve got experienced a very reasonable seller’s industry. But on account of rising home prices and you can increased interest levels, we’re today viewing an even more natural sector in which customers and you will vendors take slightly equivalent ground. You to definitely signal from the change is the previous surge within the delistings – otherwise deleting a house about field shortly after it’s been indexed obtainable. In the 1st 50 % of 2022, more 70% out-of residential property marketed on otherwise more than listing rate – a very clear sign of a beneficial seller’s , an Opendoor statement discover no more than 55% off property ended up selling in the otherwise a lot more than list rates in the 1st half of in 2010 – signaling a market where customers are putting on significantly more discussion fuel.

Additionally, home loan pricing often see a moderate decline, given the present half of-area price slash at September Given conference. Since Fed will not yourself put financial cost, a general change in borrowing from the bank can cost you usually has an impact across most other areas, as well as a residential property. The fresh Given also has signaled there may be so much more slices in the future, and therefore there is certainly far more save for buyers towards the horizon.

The current real estate market is unique because most residents enjoys extreme equity inside https://cashadvancecompass.com/installment-loans-tx/richmond/ their land regarding last few years’ appreciation, and you will low mortgage cost. This is going to make them less likely to want to sell otherwise refinance, that it slowed path from inside the a monetary ecosystem which was currently lacking homes for sale.

Lower index and low value. High financial rates is actually a dual whammy towards housing industry securing in home owners, the key way to obtain getting-business houses also provide, and you will cutting household-purchasing power.

Professional advice having basic-day home buyers

It’s got in fact become my personal favorite to acquire business across the 20 ages I was in the market. Prices have come off a little, that will help affordability, not adequate for a lot of consumers so you can flooding back again to the business. Consequently extremely consumers are actually have a tendency to able to research on several houses and not have to immediately fill out a deal that is contending that have 27 most other offers like that was taking place a good long-time back.

Consumers have alot more discussion energy than just they will have got has just – I might say from the 75% away from my purchases have some brand of seller concession, if which is a price reduction otherwise provider-paid off closing costs and you may/otherwise interest buydown. In addition feel very areas try enjoying inventory account been upwards a while, so as that setting there are a whole lot more choices to select from. So much more choices, straight down pricing, more negotiating energy, and less battle was a victory having people.

Today’s housing industry is more visitors-amicable than in the past a couple of years, but is nonetheless extremely tough. Building also provide and you can waning demand imply that people come in an excellent seemingly good reputation in many section, however, value is likely however an obstacle.