Longer Tenure

Your financial debt you can expect to develop through the years, therefore it is difficult for that make EMI money on time. You might decrease the number of the monthly installments for people who need to reassess and you can stretch the fresh new period of one’s mortgage.

This is exactly a different sort of crucial function one advances the appeal of a home mortgage equilibrium transfer. Let’s capture a good example the place you keeps a good ten-12 months mortgage kept. However now you’ve got most other obligations, together with your youngsters’ schooling, your quality of life, or any other costs.You may want a mortgage transfer in cases like this so you can boost the period from the an additional 15 otherwise 2 decades. In a way, you might decrease your EMI and you may spend some your money to other personal debt.

Credit history Improvement

Your credit score is simply dependent on how well you pay off expense. Thus, your credit rating is generally distress if you find yourself having problems paying the borrowed funds and also become frequently missing their EMI costs. In these items, a home loan harmony import may be the best bet.

You could favor a loan provider which have conditions that was right for you which have a good fees bundle. While making the loan repayments on time will allow you to take care of and you may increase credit history, that can make certain you can always get borrowing during the an sensible rates.

Best Up Mortgage Business

You’ll be able to search for a supplementary mortgage from your own the fresh new lender that with a high-right up throughout the a balance import. You might receive most financing with this specific business to fund your demands. Further, lenders provide this business from the aggressive interest rates, rendering it a practical and affordable alternatives. But be sure to make up extra will cost you and you will charge which can be of this their top-right up mortgage.

Finest Customer care

You might go for a home loan balance move into also advance customer care and additionally monetary pros. For example, you might find it challenging to generate money should your customer service provided by your present bank try perplexing or unhelpful.

Within these situations, a house financing balance transfer might be advantageous to you. Have a look at feedback regarding people, talk to experts and you may search into the new bank before choosing the bank, even though. Make sure the team at the the new lender is far more aware and offers best provider compared to one to you already have.

Transferring your residence loan from one lender to another is similar to help you an equilibrium transfer. How to reduce Your home Loan EMI which have an equilibrium Transfer? Actually, occasionally, fighting financial institutions offer premium revenue like minimal interest rates.

The primary purpose is always to reduce your monthly expenditures. Less EMIs will get effect in the event that a special financial now offers an interest rate that is less than what you’re today expenses.

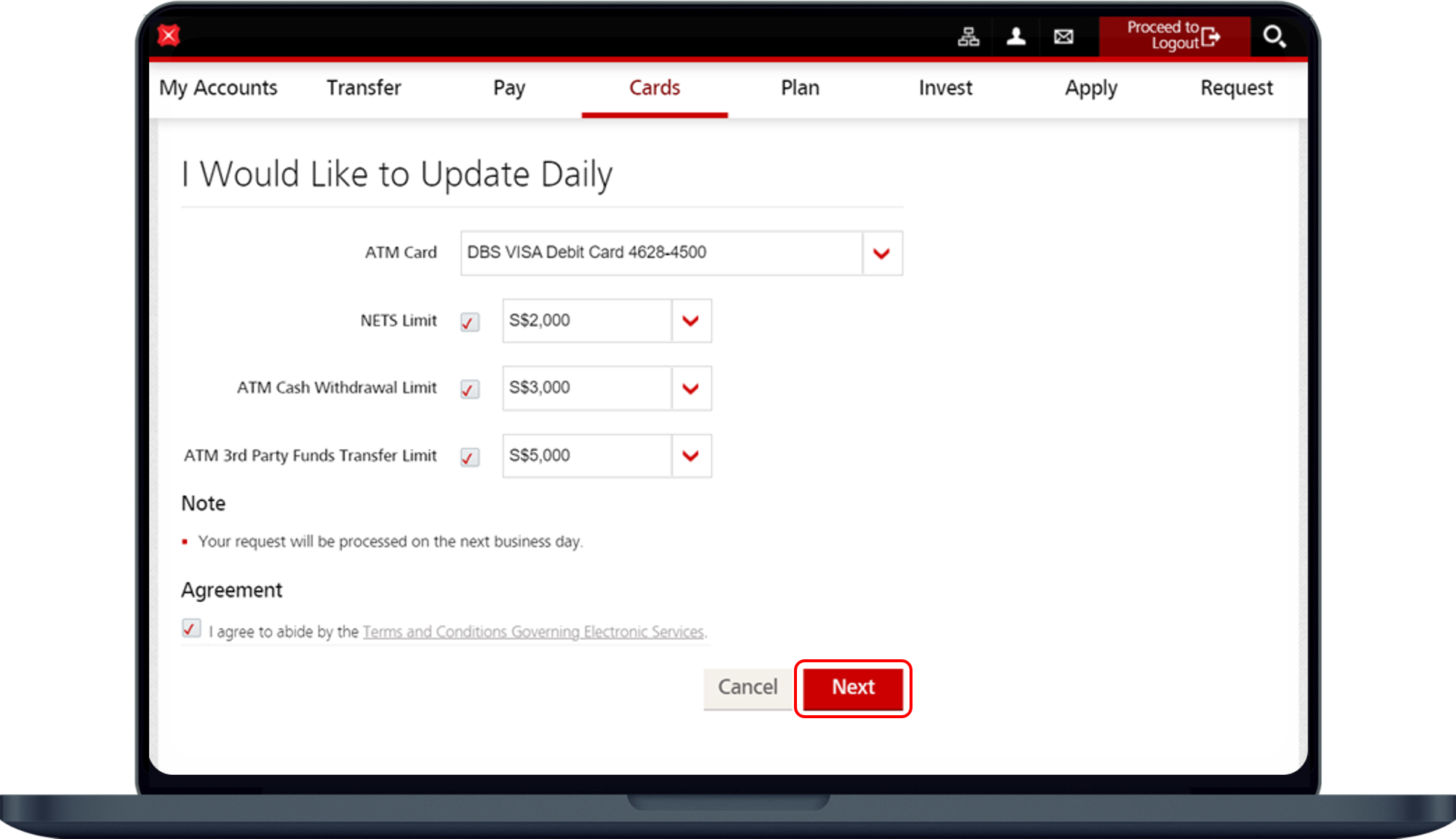

- Check your Most recent Mortgage: See the information on your home loan. It comprises the degree of your own a fantastic mortgage equilibrium, the remainder years (what number of many years you only pay), as well as your most recent rate of interest.

- Comparison shop: Consider the products of various other banking companies. See if people banking companies have to give a diminished interest. It could be the result of market changes or the update on the credit history.

- Perform the Formula: Determine the new you’ll offers regarding import. While you are there is particular https://paydayloanalabama.com/marion/ import costs, straight down rates of interest typically result in shorter EMIs. Guarantee whether the envisioned coupons counterbalance these types of costs that is home mortgage balance import calculator.

- Discover Techniques: Discover certain paperwork and many procedures in moving a great financial harmony import processes.

- Discuss together with your Current Financial: Visit your expose lender before taking one action. Let them know that you’re considering transferring to a new venue just like the the offer is greater. To try to preserve your just like the an individual, they could sometimes give you a much better package.