The goal of big data in accounting is to collect, organize, and tap data from a variety of sources to gain fresh business insights in real time. For example, instead of relying on monthly financial reports for their analyses, accountants and financial analysts have access to up-to-the-minute information from any location with a network connection. In particular, the use of data analytics in accounting and finance has been a major factor in boosting profitability and reducing the costs of doing business. Franklin has developed exceptional accounting data analytics courses at the undergraduate and graduate level.

Helping an airline improve safety, reduce costs, and better serve customers

The opposition to change and the necessity for a cultural shift within organisations highlight the significance of cultivating solvency definition a mindset that welcomes innovation and technological progress. As the accounting landscape progresses, addressing these challenges becomes crucial for remaining competitive and ensuring the precision and significance of financial insights. Additionally, it is a well-connected tool, effortlessly linking with Excel, Quickbooks, Google Analytics, and other applications.

Is financial aid available?

Illinois serves the world by creating knowledge, preparing students for lives of impact, and finding solutions to critical societal needs. The system for analysing data needs to handle more and more data without slowing down. If the initial setup doesn’t plan for future growth, there can be problems with scalability later on. Accountants dealing with extensive data, such as those in a mid-sized company, have discovered that Tableau is a robust and adaptable tool. While technical abilities are crucial, effective communication and presentation skills are equally vital.

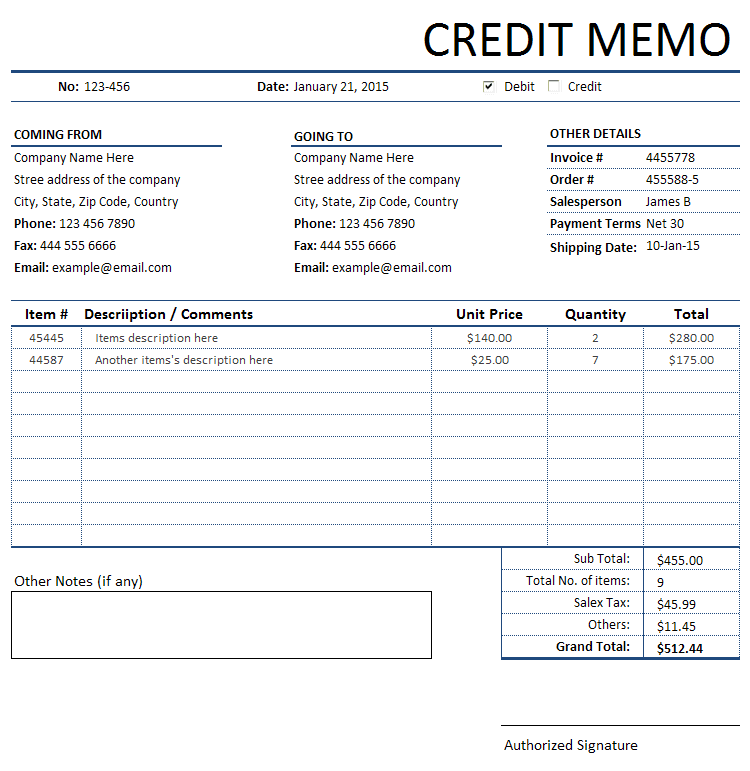

Data analytics are used by accountants to do things like discern patterns in customer spending, identify market behavior, anticipate trends and predict regulatory reactions. As the amount of available information increases so does the need to have skilled accountants who can analyze and contextualize it, which puts a particular importance on the need for accountants with strong data analytic skills. Traditionally, accounting is viewed as a retrospective activity — a necessary evil for tax preparation rather than a tool for strategic decision-making. In light of the changing nature of accounting practice, companies look for talent with a new set of skills. Ames said, “The skill to deploy assurance technologies and utilize a variety of financial and nonfinancial data is highly valued.” To better explain skill development in data analytics for CPAs, we first divide data analytics into four types as shown in the chart “4 Types of Data Analytics.”

Insights by type

By the end of this course, you’ll understand how financial data and enrolled agent non-financial data interact to forecast events, optimize operations, and determine strategy. This course has been designed to help you make better business decisions about the emerging roles of accounting analytics, so that you can apply what you’ve learned to make your own business decisions and create strategy using financial data. Projects included in this specialization allow learners to apply the skills developed within the data analytics specialization to real-world problems. For example, in the capstone project, learners will develop a machine learning model in order to predict whether a loan is to be fully paid and construct a loan portfolio with the help of the analysis. The success of accountants and finance professionals depends increasingly on understanding the opportunities that data analytics creates for their clients and their industry. Accountants with a background in data analytics qualify for a far greater range of positions in accounting and finance.

- In this module, you will learn to recognize the importance of making room for empirical enquiry in decision making.

- In light of the changing nature of accounting practice, companies look for talent with a new set of skills.

- The earning potential depends on various factors, but generally, data analysts often earn more than accountants due to the increasing demand for data-related skills.

- In particular, the use of data analytics in accounting and finance has been a major factor in boosting profitability and reducing the costs of doing business.

- Data is fast becoming the currency of business and there are important details and insights in it, if you just know where to look.

This specialization develops learners’ analytics mindset and knowledge of data analytics tools and techniques. Specifically, this specialization develops learners’ analytics skills by first introducing an analytic mindset, data preparation, visualization, and analysis using Excel. Next, this specialization develops learners’ skills of using Python for data preparation, data visualization, data analysis, and data interpretation and the ability to apply these skills to issues relevant to accounting. Accounting Analytics explores how financial statement data and non-financial metrics can be linked to financial performance. In this course, taught by Wharton’s acclaimed accounting professors, you’ll learn how data is used to assess what drives financial performance and to forecast future financial scenarios.

When will I have access to the lectures and assignments?

Excel doesn’t have a built-in logistic regression tool, so you’ll learn how to manually design a logistic regression model, and then optimize the parameters using the Solver Add-In tool. Small and medium-sized enterprises (SMEs) might face difficulty in allocating resources for the initial setup. The perceived high expense of implementation can act as a hurdle for some organisations, preventing them from adopting data analytics in accounting. Effectively incorporating data analytics demands proficient experts who grasp accounting principles and data science. Educating current accounting staff or bringing in new skilled individuals can take up a lot of time and answers about cancelled checks money. It enables organisations to stay ahead of the competition by understanding customer behaviour, market trends, and emerging opportunities.

While introducing accounting and data analytics presents notable difficulties, the possible advantages surpass the challenges. Overcoming issues tied to data quality, integration, security, and skill gaps requires thoughtful planning, investment, and a dedication to managing change. As per the Journal of Accountancy, data analytics involves gathering pertinent data, conducting analyses, and applying the insights obtained from analytics in decision-making.