Securing home financing with the common credit rating in australia try feasible, although it can come which have specific pressures including large notice rates or stricter financing criteria. By the enhancing your credit history, comparing some mortgage also offers, and perhaps seeing financial specialists, you could increase possibility of wanting a home loan that meets your debts.

Trying to safe a home loan which have the common credit rating get appear difficult, however it is certainly possible. Skills just what the average credit score was and you may examining the offered solutions is open doorways so you’re able to securing home financing lower than terms that fit the money you owe. This article will guide possible property owners from the process of obtaining a home loan with the typical credit score around australia.

Information Credit scores around australia

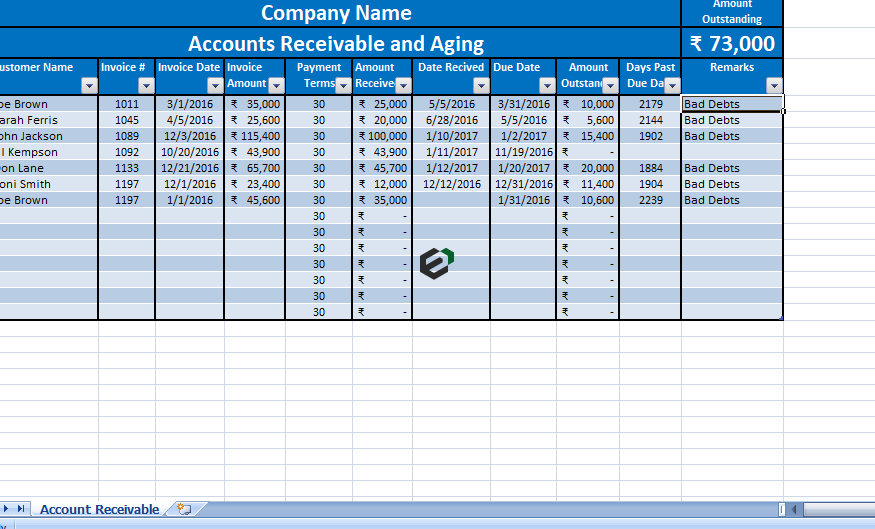

In australia, credit ratings generally speaking range from three hundred to 850. An average credit rating is said to be throughout the middle range, to five-hundred to help you 700, according to credit reporting company. Have a look at table lower than, which ultimately shows brand new range to have ‘average’ credit history, getting Equifax, Experian and you can Illion.

Fico scores are very important as they determine a good lender’s choice for the whether to offer you a home loan and on exactly what words. A top rating implies best creditworthiness, leading to most readily useful rates plus beneficial mortgage conditions.

Demands of obtaining home financing with an average Credit rating

Having the typical credit score could possibly get restrict your home loan alternatives and you may impact the regards to the mortgage. Lenders might perceive you because the increased chance compared to anybody with a high score, that may lead to large interest levels or a significance of a more impressive down-payment. While doing so, the borrowed funds recognition procedure would-be way more strict, requiring a lot more comprehensive records to show debt balance.

Home loan Options for Those with Average Credit ratings

- Conventional Mortgages: While you are stringent, conventional loan providers perform accept consumers that have average scores, commonly adjusting loan words in order to mitigate chance.

- Special Programs: Certain loan providers give programs specifically designed of these that have average credit ratings. Such you are going to is somewhat large rates however, so much more versatile degree standards.

- Non-Lender Loan providers: These types of associations will often have way more versatile credit conditions than conventional banking companies and can even getting a practical alternative.

Boosting your Credit rating Before applying

- Normal Payments: Be sure to pay-all costs and you may present financing promptly.

- Credit report Inspections: On a regular basis look at the credit history getting discrepancies or dated pointers.

- Straight down Borrowing from the bank Utilisation: Try to keep their bank card balances well below the constraints.

Papers and needs

- Evidence of Income: Spend slides, tax statements, and you may work details.

- Monetary Statements: Bank statements and every other monetary assets.

- Credit score: Done details of your credit history, as well as fund, credit cards, and other bills.

Evaluating Different Mortgage Also offers

Doing your research is essential when you have the common credit rating. Fool around with gadgets including on line home loan hand calculators and you can analysis other sites examine various other mortgage even offers. Research not only from the rates as well as at the charges, financing keeps, and you may freedom for the best complete worthy of.

Instance Knowledge

Consider the tale off Victoria, an instructor during the Melbourne that have a credit score out-of 650. She effectively shielded a mortgage shortly after doing your research and you can in search of a great lender one featured beyond her credit history so you’re able to their own historical a position and you may limited obligations. Victoria’s instance portrays by using persistence and you may careful think, obtaining a home loan which have an average credit history can be done.

Qualified advice

Economic advisors and home loans provide invaluable advice for navigating the mortgage process having the average credit score. They can bring customised methods considering the money you owe and goals. Such as for instance, they could recommend would love to use until snap the site shortly after improving your borrowing from the bank rating or looking into specific lenders that noted for much more flexible credit conditions.

End

And get the common credit score get expose certain challenges into the the mortgage software procedure, it does not stop you from getting home financing around australia. That have cautious preparing, suitable financial, and possibly specific qualified advice, there are a home loan that suits the money you owe.