Into the a knowledge economy that individuals live in today, education takes on a pivotal part. Degree empowers us to reach this new heights in our job, permits to call home a reputable lifetime, elevates our total well being, supports to accomplish financial requirements, and a lot more!

Training Funds are for sale to job-concentrated programmes like medication, technologies, and you will administration at each other undergraduate and postgraduate membership during the better associations inside the Asia and you may to another country. Such financing can also be defense an array of costs, and tuition, exam charges, collection memberships, books, requisite research gizmos, computers, and rental costs, when the relevant.

Children is in person apply for a training mortgage. Although not, its moms and dad(s) otherwise protector might possibly be treated due to the fact co-applicants, as well as their role is akin to a first borrower (a person who owes currency).

Before you sign up for a degree financing, since the a wise financing believe do so, evaluate simply how much the newest Equated Monthly Instalment (EMI) will be.

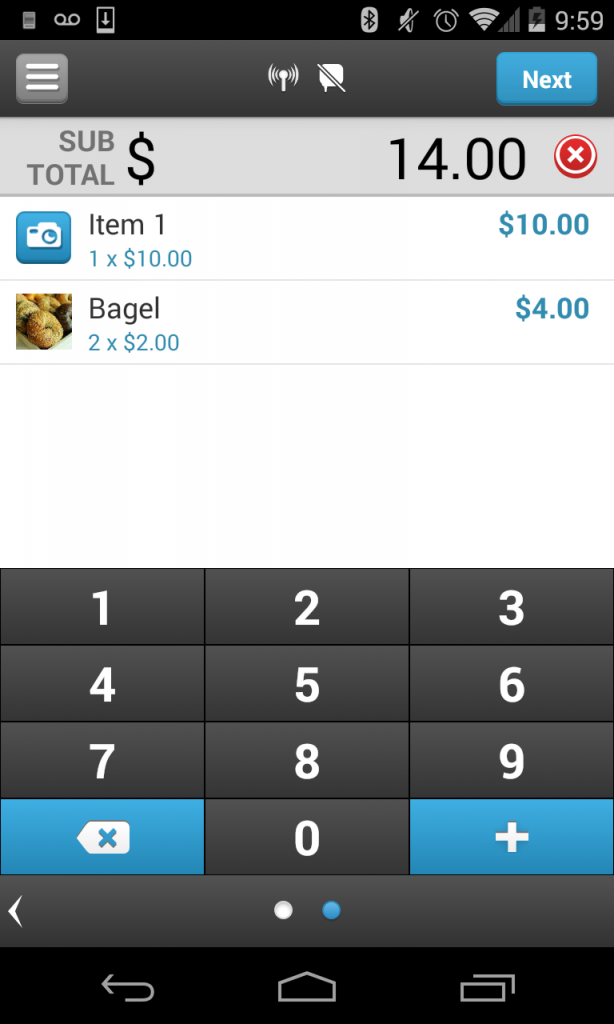

Break-upwards off Total Payment

This new EMI of your financing consists of the principal part and you will the interest. During the early stages of your own loan’s label, a more impressive part of the EMI happens toward paying off the latest notice. Over time, once the mortgage harmony decrease, more of the percentage is used on the main amount.

Axis Financial India has the benefit of training money in the attractive rates of interest getting a loan amount between Rs 50,000 in order to Rs 75 lakh.

Disclaimer

Axis Bank doesn’t make certain accuracy, completeness otherwise correct sequence of any the details offered therein and you may ergo no reliance would be set by the associate the objective after all with the guidance contains / investigation made here or toward their completeness / precision. Using any recommendations establish is very at Owner’s very own chance. Member is do so due worry and you will caution (and if required, obtaining out-of suggest out of tax/ legal/ accounting/ financial/ most other gurus) before taking of any choice, acting otherwise omitting to act, in line with the suggestions consisted of / study produced herein. Axis Bank doesn’t deal with any accountability otherwise responsibility so you’re able to revision any research. No-claim (if for the offer, tort (also neglect) otherwise) should arise regarding or even in connection with the assistance against Axis Bank. Neither Axis Financial nor some of their representatives otherwise licensors or group organizations will be liable to user/ any third party, for your lead, secondary, incidental, special otherwise consequential losses otherwise injuries (in addition to, without maximum to possess death of profit, business opportunity otherwise death of goodwill) after all, if or not for the bargain, tort, misrepresentation otherwise as a result of the aid of these tools/ pointers contained / analysis generated here.

Frequently asked questions

- The fresh new applicant and you can co-candidate should be more 18 yrs old and citizen out of Asia

- The new scholar requires safeguarded at the very least fifty% marks while in the HSC and graduation

- Brand new beginner will need to have received admission in order to industry-created programmes viz. Medication, Technology, Administration, etcetera., both during the scholar or post-graduate level

- Shielded entryway into the India or abroad regarding an existing school/education organization courtesy entry try/merit depending alternatives procedure blog post conclusion from HSC (10+2), is extremely important

- The co-candidate, we.age. parent(s) otherwise protector, have to have a consistent income source

- Income statements (Salary sneak, Function 16, Income-Taxation statements of one’s last 2 years, and you will Calculation cash out of last 24 months authoritative because of the a beneficial Chartered Accountant)

- Lender Report/Admission Book of past 6 months

- Content of your own entryway page of Institute and the commission schedule’

- Draw sheet sets and you will/otherwise pass certificates from SSC, HSC, Studies Courses, Federal peak entrances test

The financial institution sanctions the training loan just immediately after thorough due diligence. Axis Financial constantly disburses loans within fifteen weeks regarding day out-of bill of done app as well as all of the records needed getting the full appraisal.

There is absolutely no margin to own studies fund upto Rs 4 Lakhs. Getting money above Rs cuatro Lakh, the latest margin for training within this India is actually 5% and also for training overseas was fifteen%.

For next disbursements as well, some of the the latter documents could well be needed, particularly the consult page from the school, DRF, receipt of improvements report, draw layer, bonafide certification.

Sure, Rs five-hundred + taxes for each and every cheque jump and you may an effective penal interest % yearly i.age. 2% a month to the delinquent instalment/s. So, in terms of you’ll, keep repayment track content record brush.

Yes. The interest part of the latest EMI paid off into a studies mortgage was deductible below Section 80E of your Tax Work out of 1961, that will offer income tax recovery.