President and you will Co-Founder of Stairs Financial, an excellent YC-recognized startup you to definitely links first-time homebuyers with advance payment assistance applications over the You. Malcolm-Wiley examined economics during the Harvard that is a licensed large financial company.

If you are intending to shop for a house in the Tx, determining simply how much you want to own a deposit is actually probably the first buy out-of business. But, simply how much money do you want? Even though the audience is from the they, what’s the average advance payment toward a property inside Colorado?

Its an excellent question to ask. If you know simply how much anyone generally speaking pay with the a straight down commission, you can probably pursue equivalent selection.

We have complete brand new math for you, calculating the common down-payment statewide from inside the Colorado, and averages per major metropolitan area.

Disclaimer: This article is to possess informational purposes merely and cannot feel thought to be court otherwise monetary pointers. Excite consult an attorney, lending company, otherwise CPA for guidance on your specific state.

With regards to the National Relationship off Real estate professionals, the typical deposit with the a home for basic-big date homebuyers nationwide was 6%. Since the the newest average household rates into the Tx are $301,763*, that towns and cities the average down-payment towards a house inside Tx at the $18,105 for basic-time home buyers.

Remember that six% was the common. It commission may differ right up or down dependent on for every household client’s disease. As well as, for many individuals, half dozen per cent is not always the optimal total set-out to your an initial household.

Three per cent ‘s the lowest down-payment for FHA fund, though some loan products enjoys large or straight down minimums. One of the biggest benefits to and come up with a high advance payment is the rate of interest prevention it buys you. Your rate of interest just decreases from the 5%, 10%, otherwise 20% down.

Because the there is no interest rate decrease for raising their deposit out-of 5% to 6%, it will be ideal on the situation and make a great 5% down payment and you can save your self the other cash having unforeseen repairs, swinging expenses, or even the for example.

Instead, you happen to be able to utilize the excess coupons to get off your interest. The home loan elite will allow you to learn all the choice online.

This type of numbers are derived from brand new six% federal mediocre down-payment getting very first-day people, along with the newest average home rate each certain metropolitan urban area.

To order a house inside the Colorado? Find out more

To make an advance payment could be the earliest product your handle home to shop for processes, but it’s certainly not the only one. Here are a few these almost every other stuff in the buying a house when you look at the Tx.

Just how do earliest-date people inside Texas put together its off repayments?

If the these down-payment amounts end up being some time overwhelming, you aren’t by yourself. Twenty six % out of basic-big date homebuyers declare that saving to have a downpayment is actually the most difficult element of their property pick processes.

It would be a challenge, but delivering a downpayment together is certainly you can easily. Here you will find the most common suggests very first-time home buyers come up with off repayments.

Seasoned loans

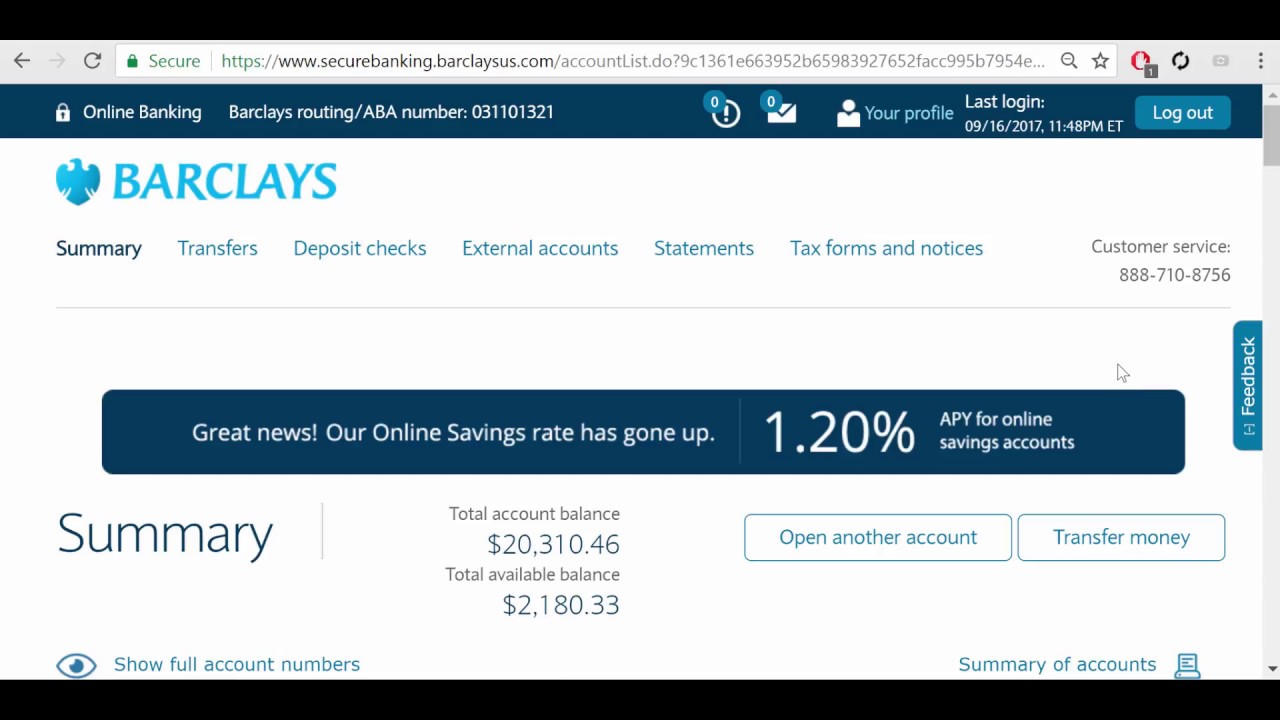

Forty-7 percent regarding consumers explore private deals and also make no less than the its down-payment. But lenders should make yes the bucks on your own bank membership originates from your very own discounts, as opposed to a separate, undisclosed supply (eg financing off another institution otherwise something special you did not speak about).

It means really loan providers want one to people individual money you employ for your downpayment could have been seasoned. This means, you will need to demonstrate that the money has been around your own checking account to possess the absolute minimum timeframe, usually 60 days.

You are naturally allowed to use-money off their supply, for example gift ideas, fund, and other advance payment recommendations, but you’ll need inform you evidence of the newest money’s root.

Gifted money

Merchandise and you will financing away from family unit members or loved ones also are a familiar source of advance payment financial support to possess very first-big date people. Twenty-a few percent of brand new consumers obtain downpayment in that way.

For individuals who wade this station, carry out be mindful that there are laws in the recording a skilled deposit. Such, anyone otherwise providers deciding to make the current needs to provide documents clearly demonstrating the money does not need to be distributed straight back.

Down payment guidelines (DPA) loan places Alabaster might not be the most used source of down-payment funds getting first-time home buyers, nevertheless probably should be.

DPA apps render extreme sums of cash to simply help people generate the largest downpayment it is possible to, and several apps don’t require you to repay those funds.

Wanting providing down-payment guidance within the Colorado? There are certain DPA programs to possess homebuyers about condition.

Benefits of a bigger down payment

Though some types of loans will let you get property with little to no or no currency down, there are certain advantageous assets to and come up with a beneficial-measurements of deposit, whenever you.

Even as we said earlier, a much bigger deposit makes it possible to get the best interest rate, especially if it’s possible to strike the 5%, 10%, or 20% draw. Likewise, making an enormous deposit function you may not must obtain normally money, hence expands the to acquire strength and reduces the monthly premiums.

Of course, everything is a good tradeoff. To learn more, listed below are some the help guide to the huge benefits and downsides away from an effective high advance payment.

Other initial can cost you to adopt

The fresh new downpayment is the most recognized initial costs for the to get property, however it is not by yourself. There are even settlement costs and this must be repaid from the time of get.

Closing costs cover tertiary expenditures connected with to purchase a property particularly due to the fact financing origination charge, label charge, and taxes. Settlement costs usually get wrapped into the home mortgage. Yet not, you can want to spend settlement costs out of pocket to help you prevent increasing your loan amount.

Settlement costs to have buyers when you look at the Texas mediocre around 1.5% of your home’s revenue rate, even though this varies based on their appropriate location and some most other factors.

Rescuing up having a deposit normally positively be achieved, it takes some time and effort. Downpayment recommendations (DPA) can help you make the biggest down payment possible that have less days invested cutting expenditures and you will protecting most of the penny.

DPA applications give many or even tens of thousands of cash to help homebuyers buy a home having less stress on the cash. Better yet, you will find DPA apps built to suit all kinds of economic things.

New most difficult region from the getting advance payment help is wanting guidance on which apps you be eligible for, to examine the choices and also make many advised decision.

Stairs connects your that have a reliable financial who works with DPA, up coming matches you with all of the down payment direction programs you could be eligible for – all-in-one place, in order to compare your alternatives apples-to-oranges.